By Chris Kirkham

Major hotel chains are engaging in an online turf war with the

very travel sites that have helped drive their businesses.

Marriott International Inc., Hilton Worldwide Holdings Inc. and

InterContinental Hotels Group are using extensive marketing

campaigns to claw back business from Expedia Inc., Priceline Group

Inc. and other travel-booking sites, which steer customers to hotel

properties but also take commissions of up to 30% for each

reservation. The chains are starting to treat these sites less as

valuable business partners and more as gatekeepers standing between

them and their customers.

Many large hotel brands are offering lower nightly rates and

other perks to loyalty members who book directly through their

sites instead of online travel agencies.

The industry effort faces an uphill climb, however, as travel

portals have become ubiquitous tools for planning a trip. Online

travel agencies were responsible for $99 billion worth of

world-wide hotel bookings last year, according to travel

industry-research group Phocuswright.

A survey conducted by travel-data firm Adara Inc. showed that

52% of U.S. travelers between the ages of 18 and 34 prefer booking

hotels through online search engines as opposed to brand websites,

compared with 37% age 35 and older. Younger travelers are also less

likely to participate in hotel-rewards programs, the survey found,

raising questions about how much brand loyalty matters to

price-sensitive customers. Many prefer third-party sites because

they show an array of options and allow customers to package

airfare or car rentals.

"I always want to find the good deal, and see what all my

options are first," said Nicole Leffew, 28 years old, a bartender

and fashion blogger from Ohio. She said she rarely consults the

hotels' websites because she feels "they don't have that much."

The new battle is the latest episode in a two-decade

"frenemy"-style relationship between online travel agencies and the

hotel industry. Sites such as Expedia and Priceline were crucial

for hotels during down periods such as after 9/11, but they have

gradually eaten into the share of overall bookings ever since.

For major airlines, the battle with booking portals isn't as

pronounced since there are far fewer airlines than hotel chains.

But hotels are facing a conundrum that frustrates many industries

in the internet age, from Hollywood to the music industry: Online

middlemen deliver a vital stream of customers, but end up taking a

cut of profit. The 10% to 30% commissions that online travel

agencies charge for each night represent an expensive customer

pipeline for hotel owners who already pay fees to major brands such

as Hilton and Marriott.

Commissions associated with online travel agencies cost the U.S.

hotel industry an estimated $4.5 billion for the 12 months ending

last June, according to research from hotel industry consultant

Kalibri Labs.

"It's always been a thorn in our side," said Mark Ricketts,

president and chief operating officer of McNeill Hotel Co., which

owns and operates more than a dozen Hilton- and Marriott-affiliated

hotels in seven states.

Chris Silcock, Hilton's executive vice president and chief

commercial officer, said a goal has been "educating customers" and

changing their behavior. "There had been this perception that to

get the best price, you book through a different channel than going

direct," he said. "That's never actually been the case."

Hotel bookings are the biggest source of growth for online

travel agencies. Last year, the value of hotel bookings through

third-party travel agencies in the U.S. grew to $31.4 billion,

surpassing direct hotel online bookings for the first time since

the data was tracked beginning in 1998, according to Phocuswright.

The sites spend heavily on marketing: The more than $8.5 billion

spent globally on sales and marketing by Expedia and Priceline

Group alone last year is likely on par with the entire world-wide

hotel industry, the group estimated.

Hotels have responded with advertising campaigns such as "Stop

Clicking Around," Hilton's largest-ever marketing effort, and

Choice Hotels International Inc.'s "Badda Book. Badda Boom"

effort.

Brands have been tweaking their loyalty programs to extend

immediate benefits to casual travelers, not just frequent business

travelers.

Hilton earlier this year began allowing its points to be used

toward Amazon.com Inc. purchases, and Choice Hotels, which operates

the Comfort Inn and Quality Inn chains, allows customers to redeem

points for Starbucks gift cards and gas discounts. Brands are also

offering certain services, such as free Wi-Fi or the ability to

choose a room, only to customers who book direct.

Brian King, global sales officer at Marriott International, said

the goal is to convert casual customers into loyal guests who "stay

the most, and they pay the most."

Online travel agency executives said their platforms draw

customers who might not otherwise think to book with a particular

chain.

"Free is best. Everyone would like people to come direct to

their business," said Glenn Fogel, chief executive of Priceline

Group. "That's not the way the world works, though."

Expedia CEO Dara Khosrowshahi added: "We just want to get you to

the right hotel, whereas the chain wants to get you to their

hotel."

Kerry Ranson, chief development officer of HP Hotels, which

manages more than 40 hotels for Hilton and others, said the biggest

unknown is whether new loyalty members actually return. "Do those

become truly active members, or are they one and done? They did it

just to get the cheap rate," he said. "That's what's still left to

be played out."

Write to Chris Kirkham at chris.kirkham@wsj.com

(END) Dow Jones Newswires

May 28, 2017 08:46 ET (12:46 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

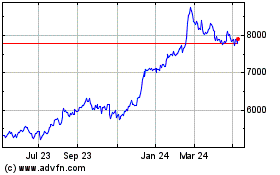

Intercontinental Hotels (LSE:IHG)

Historical Stock Chart

From Mar 2024 to Apr 2024

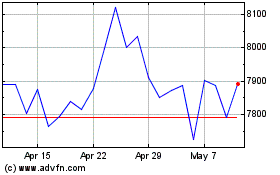

Intercontinental Hotels (LSE:IHG)

Historical Stock Chart

From Apr 2023 to Apr 2024