BOND REPORT: 30-year Treasury Yield Snaps Six-day Streak Of Declines

25 July 2017 - 7:31AM

Dow Jones News

By Sunny Oh

Treasury traders will await the FOMC statement on Wednesday for

signs of how the central bank is processing weak economic data

Treasury yields climbed Monday as traders braced for a Federal

Reserve policy meeting starting Tuesday that could help to provide

further clarity on the central bank's approach to tackling sluggish

inflation and scaling back its $4.5 trillion asset portfolio.

The yield on the 30-year bond added 3.1 basis points to 2.833%,

ending a six-day streak of declines. The yield on the 10-year

Treasury note rose 2.1 basis points to 2.253%, while the 2-year

note's yieldgained 2.1 basis points to 1.365%.

In particular, long-dated Treasury yields came under selling

pressure, pushing yields, which move inversely to prices, higher as

investors took money off the table following a two-week surge in

government-bond prices, on the back of a wave of lackluster

economic data and dovish central bank speeches. Hundreds of

millions of dollars left from the largest exchange-traded fund

tracking long-dated Treasurys(TLT) in the week ending July 21

(http://www.marketwatch.com/story/investors-withdraw-from-long-dated-treasurys-etf-2017-07-24).

Although market participants expect few changes

(http://www.marketwatch.com/story/stocks-brace-for-volatility-as-earnings-peak-weak-fed-meeting-loom-2017-07-22)

to the language of the coming updated policy statement, they will

closely watch for indications that weakening data have unnerved

members of the Federal Open Market Committee. That said, the

central bank tends to be reluctant to make major tweaks to policy

language on FOMC meetings without a corresponding news

conference.

"The economy definitely seems to be shifting into lower gear,

whether the Fed chooses to amend the statement and address some of

those problems, this could move the market," said Mary Ann Hurley,

vice president of fixed-income trading at D.A. Davidson.

Adding to the downbeat reports, the International Monetary Fund

on Sunday lowered its U.S. growth forecast for 2017 to 2.1% from

2.3% as economists cut their expectations for President Donald

Trumps's pro-growth agenda. The president's one-two-three punch of

tax cuts, deregulation and infrastructure spending, were the

signature pledges that helped to get him into the Oval Office and

which weighed on Treasurys, initially jolting yields firmly higher

back in November. But the failure to overhaul the Affordable Care

Act, known as Obamacare, has cast doubt on his ability to leverage

from a Republican majority on Capitol Hill and push through other

legs of his legislative agenda.

This reflected that "fiscal policy will be less expansionary

going forward than previously anticipated," according to their

World Economic Outlook update

(http://www.imf.org/en/Publications/WEO/Issues/2017/07/07/world-economic-outlook-update-july-2017).

See: IMF cuts U.S. growth forecast for 2017, 2018

(http://www.marketwatch.com/story/imf-cuts-us-growth-forecast-for-2017-2018-2017-07-24)

Despite the muted backdrop, many still expect the Fed to signal

its plans to reduce its balance sheet starting as early as

September, even as it pushes back the schedule for normalizing

interest rates. Though the tapering of the Fed's asset portfolio

has caused some jitters about the potential impact

(http://www.marketwatch.com/story/will-the-feds-balance-sheet-unwind-catch-investors-by-surprise-2017-05-03)

on the Treasury market, the gradual pace of the roll-off is

unlikely to trigger investors' flight from the largest market for

government paper in the world, said some analysts. A reduction in

the central bank's asset portfolio, accumulated during the 2008-'09

financial crisis, can also serve to raise borrowing costs,

tightening lending conditions on Wall Street.

Read:Jamie Dimon says QE unwind could catch investors by

surprise

(http://www.marketwatch.com/story/jamie-dimon-says-qe-unwind-could-catch-investors-by-surprise-2017-07-11)

"The FOMC appears to have put rate normalization on the back

burner for the time being," wrote Ward McCarthy, chief financial

economist for Jefferies.

On the data front, existing-home sales for June came in at an

annual rate of 5.52 million

(http://www.marketwatch.com/story/existing-home-sales-fall-in-june-as-market-retrenches-after-hot-spring-season-2017-07-24),

the lowest pace since February, missing an average forecast of

economists polled by MarketWatch of 5.58 million.

Looking ahead, the Treasury Department is slated to sell $88

billion of U.S. government paper in tenors ranging from 2 years to

7 years.

Elsewhere, the German 10-year bond yield was at 0.51%. German

bond yields slipped last week after European Central Bank President

Mario Draghi's dovish remarks caused the euro to surge above $1.16,

moving investors out of equities and into eurozone sovereign debt

(http://www.marketwatch.com/story/treasury-yields-fall-as-dovish-comments-from-ecbs-draghi-fuel-bond-buying-2017-07-21).

(http://www.marketwatch.com/story/treasury-yields-fall-as-dovish-comments-from-ecbs-draghi-fuel-bond-buying-2017-07-21)

(END) Dow Jones Newswires

July 24, 2017 17:16 ET (21:16 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

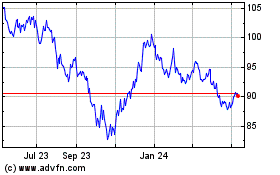

iShares 20 plus Year Tre... (NASDAQ:TLT)

Historical Stock Chart

From Mar 2024 to Apr 2024

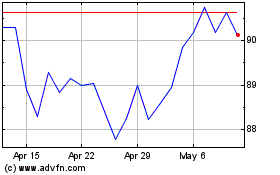

iShares 20 plus Year Tre... (NASDAQ:TLT)

Historical Stock Chart

From Apr 2023 to Apr 2024