TIDMNHY

Hydro's underlying earnings before financial items and tax increased to

NOK 2,930 million in the second quarter from NOK 2,284 million in the

first quarter, mainly driven by higher aluminium prices and favourable

currency developments. Lower realized alumina prices and increased raw

material costs had a negative impact on results.

-- Underlying EBIT of NOK 2 930 million

-- Higher realized aluminium prices, somewhat offset by lower realized

alumina prices and higher raw material costs

-- Weak Rolled Products results primarily due to reduced margins

linked to product mix and operational issues

-- Record quarterly result in Sapa

-- Better program on track for 2017 target of NOK 500 million

-- Agreement to acquire Sapa, closing expected in second half 2017

-- Karmøy Technology Pilot on time and budget, expected start-up

Q4 2017

-- 2017 global primary demand growth outlook 4-6%, global market

largely balanced

"Higher aluminium prices in the quarter are lifting results, and I am

pleased to see Sapa delivering record results, continuing the strong

trend," says President & CEO, Svein Richard Brandtzæg. "Hydro will

confirm its position as the world's leading integrated aluminium company

with the agreement to acquire Orkla's 50 percent interest in

world-leading extrusion company Sapa. The transaction reinforces our

strategic direction to become better, bigger and greener, with a solid

asset base, unique competencies and capabilities along the full value

chain," says Brandtzæg. Closing is expected in the second half of

2017, pending regulatory approvals.

Underlying EBIT for Bauxite & Alumina decreased from the first quarter.

Lower realized alumina prices, driven by a weaker alumina index and

higher raw material consumption weighed on results, while higher sales

volumes contributed positively. The Alunorte alumina refinery and the

Paragominas bauxite mine had higher production in the second quarter

following planned maintenance in the first quarter. The ongoing ramp-up

process of the new press filter operation to remove and recycle caustic

soda from bauxite residue caused additional cost at the alumina

refinery.

Underlying EBIT for Primary Metal increased in the second quarter due to

higher realized all-in metal prices, partly offset by higher raw

material costs.

Underlying EBIT for Metal Markets improved significantly in the second

quarter, mainly due to positive inventory valuation and currency effects,

in addition to better results from sourcing and trading activities.

Results from remelters also improved in the second quarter driven by

increased sales volumes and contribution margins.

"We see a global primary aluminium deficit in the quarter. This is

driven by increasing deficit outside China. For the full year, we are

maintaining our 4-6 percent annual aluminium demand growth outlook for

2017 and expect a largely balanced, global aluminium market," says

Brandtzæg.

Underlying EBIT for Rolled Products decreased in the quarter compared to

the first quarter of 2017. The decrease was primarily due to reduced

average margins driven by product mix, and an accrual for employee

compensation mainly relating to previous years. The operational issues

in the first quarter were partly resolved, reducing the negative cost

effects on the second quarter results. The Neuss aluminium plant

benefited from the all-in metal price development and lower alumina

cost.

Underlying EBIT for Energy decreased compared to the previous quarter,

mainly due to seasonally lower production and prices.

Underlying EBIT for Sapa increased compared to the previous quarter,

delivering record quarterly result, in line with general seasonality in

the industry but also related to improved performance.

Hydro continued to make progress on its "Better" improvement program.

While slightly behind plan, Hydro still expects to reach both the

year-end target of NOK 500 million and the 2019 target of NOK 2.9

billion.

Hydro's net cash position increased by NOK 0.1 billion to NOK 6.0

billion at the end of the quarter. Net cash provided by operating

activities amounted to NOK 4.3 billion, including dividends received

from Sapa of NOK 1.5 billion and operating capital build-up due to

seasonality and higher prices. Net cash used in investment activities,

excluding short term investments, amounted to NOK 1.1 billion. During

the second quarter dividends paid to Norsk Hydro ASA shareholders

amounted to NOK 2.6 billion.

Reported earnings before financial items and tax amounted to NOK 2,946

million for the second quarter. In addition to the factors discussed

above, reported EBIT included net unrealized derivative losses of NOK 66

million and positive metal effects of NOK 138 million. Reported earnings

also included a net loss of NOK 56 million in Sapa (Hydro's share net of

tax) relating to unrealized derivative losses and net foreign exchange

losses.

Net income amounted to NOK 1,562 million in the second quarter. This

includes a net foreign exchange loss, mainly unrealized, of NOK 918

million reflecting a weakening of BRL against USD affecting US dollar

debt in Brazil, while the strengthening of EUR forward rates against NOK

resulted in an unrealized loss on the embedded derivatives in power

contracts denominated in EUR.

Change

Second First Change Second prior First First

Key financial information quarter quarter prior quarter year half half Year

NOK million, except per share data 2017 2017 quarter 2016 quarter 2017 2016 2016

Revenue 24,591 23,026 7 % 20,391 21 % 47,617 40,529 81,953

Earnings before financial items and tax (EBIT) 2,946 2,410 22 % 1,978 49 % 5,356 3,672 7,011

Items excluded from underlying EBIT (16) (126) 87 % (360) 96 % (141) (552) (586)

Underlying EBIT 2,930 2,284 28 % 1,618 81 % 5,214 3,119 6,425

Underlying EBIT :

Bauxite & Alumina 662 756 (12) % 174 >100 % 1,418 363 1,227

Primary Metal 1,486 900 65 % 702 >100 % 2,386 1,020 2,258

Metal Markets 244 24 >100 % 75 >100 % 268 241 510

Rolled Products 84 106 (21) % 242 (65) % 191 491 708

Energy 284 423 (33) % 301 (6) % 707 699 1,343

Other and eliminations 170 74 >100 % 125 37 % 245 306 380

Underlying EBIT 2,930 2,284 28 % 1,618 81 % 5,214 3,119 6,425

Earnings before financial items, tax, depreciation

and

amortization (EBITDA) 4,335 3,762 15 % 3,222 35 % 8,097 6,131 12,485

Underlying EBITDA 4,319 3,637 19 % 2,862 51 % 7,956 5,578 11,474

Net income (loss) 1,562 1,838 (15) % 2,077 (25) % 3,401 4,459 6,586

Underlying net income (loss) 2,214 1,580 40 % 1,126 97 % 3,795 1,949 3,875

Earnings per share 0.73 0.86 (16) % 0.95 (24) % 1.59 2.08 3.13

Underlying earnings per share 1.04 0.75 38 % 0.52 >100 % 1.79 0.91 1.83

Financial data:

Investments 1,420 1,372 4 % 1,711 (17) % 2,792 3,681 9,137

Adjusted net cash (debt) (5,146) (5,358) 4 % (8,758) 41 % (5,146) (8,758) (5,598)

Key Operational information

Bauxite production (kmt) 2,943 2,400 23 % 2,609 13 % 5,343 5,292 11,132

Alumina production (kmt) 1,576 1,523 3 % 1,554 1 % 3,099 3,071 6,341

Primary aluminium production (kmt) 523 516 1 % 518 1 % 1,039 1,032 2,085

Realized aluminium price LME (USD/mt) 1,902 1,757 8 % 1,546 23 % 1,828 1,522 1,574

Realized aluminium price LME (NOK/mt) 16,265 14,798 10 % 12,826 27 % 15,517 12,887 13,193

Realized USD/NOK exchange rate 8.55 8.42 2 % 8.30 3 % 8.49 8.47 8.38

Rolled Products sales volumes to external market

(kmt) 239 241 (1) % 238 0 % 480 467 911

Sapa sales volumes (kmt) 180 178 1 % 183 (2) % 357 358 682

Power production (GWh) 2,369 2,869 (17) % 2,674 (11) % 5,238 5,835 11,332

Investor contact

Contact Stian Hasle

Cellular +47 97736022

E-mail Stian.Hasle@hydro.com

Press contact

Contact Halvor Molland

Cellular +47 92979797

E-mail Halvor.Molland@hydro.com

Cautionary note

Certain statements included in this announcement contain forward-looking

information, including, without limitation, information relating to (a)

forecasts, projections and estimates, (b) statements of Hydro management

concerning plans, objectives and strategies, such as planned expansions,

investments, divestments, curtailments or other projects, (c) targeted

production volumes and costs, capacities or rates, start-up costs, cost

reductions and profit objectives, (d) various expectations about future

developments in Hydro's markets, particularly prices, supply and demand

and competition, (e) results of operations, (f) margins, (g) growth

rates, (h) risk management, and (i) qualified statements such as

"expected", "scheduled", "targeted", "planned", "proposed", "intended"

or similar.

Although we believe that the expectations reflected in such

forward-looking statements are reasonable, these forward-looking

statements are based on a number of assumptions and forecasts that, by

their nature, involve risk and uncertainty. Various factors could cause

our actual results to differ materially from those projected in a

forward-looking statement or affect the extent to which a particular

projection is realized. Factors that could cause these differences

include, but are not limited to: our continued ability to reposition and

restructure our upstream and downstream businesses; changes in

availability and cost of energy and raw materials; global supply and

demand for aluminium and aluminium products; world economic growth,

including rates of inflation and industrial production; changes in the

relative value of currencies and the value of commodity contracts;

trends in Hydro's key markets and competition; and legislative,

regulatory and political factors.

No assurance can be given that such expectations will prove to have been

correct. Hydro disclaims any obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

This information is subject to the disclosure requirements pursuant to

section 5-12 of the Norwegian Securities Trading Act.

Q2 2017 Presentation: http://hugin.info/106/R/2122596/809369.pdf

Q2 2017 Report: http://hugin.info/106/R/2122596/809398.pdf

This announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Norsk Hydro via Globenewswire

http://www.hydro.com/en/?WT.mc_id=Pressrelease

(END) Dow Jones Newswires

July 25, 2017 01:15 ET (05:15 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

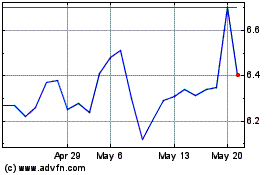

Norsk Hydro ASA (QX) (USOTC:NHYDY)

Historical Stock Chart

From Mar 2024 to Apr 2024

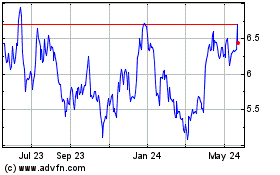

Norsk Hydro ASA (QX) (USOTC:NHYDY)

Historical Stock Chart

From Apr 2023 to Apr 2024