Oil Edges Higher After U.S. Crude Stocks Fall

03 August 2017 - 8:25PM

Dow Jones News

By Sarah McFarlane and Biman Mukherji

Oil futures nudged higher on Thursday, building on a rebound

overnight after investors ultimately took a bullish view on weekly

U.S. inventory data.

Brent crude, the global oil benchmark, rose 0.3% to $52.54 a

barrel on London's ICE Futures exchange. On the New York Mercantile

Exchange, West Texas Intermediate futures were trading up 0.3% at

$49.75 a barrel.

The Energy Information Administration reported a

1.5-million-barrel drop in U.S. crude inventories last week, below

analysts' expectations. However, "a strong increase in demand was

enough to appease the bullish investors," said ANZ Bank. Refiners'

capacity utilization jumped to 95.4% last week, the government also

said.

Brent crude prices hit a two-month high on Tuesday, having

climbed steadily in recent weeks on signs that the market is

rebalancing after more than three years of oversupply.

"A decent chunk of the global inventory overhang has been run

down and that process continues and is picking up pace," said

Richard Mallinson, analyst at consultancy Energy Aspects.

Production caps led by the Organization of the Petroleum

Exporting Countries and Russia, along with strong demand, are

helping dent still-historically high global stocks, he added.

JBC Energy revised its forecast for global oil product demand

growth in 2017 to 1.46 million barrels a day, compared with its

January forecast of 1.1 million barrels a day, due to strong demand

for gas oil and gasoline in some countries.

Market participants continued to monitor tensions in Venezuela,

where the threat of U.S. sanctions on the oil sector remains.

"The market is still watching for how that might unfold and

trying to understand if any sanctions were imposed to what extent

would it reduce Venezuelan production or exports," said Mr.

Mallinson, adding that issues facing the industry included a lack

of investment, maintenance and a shortage of equipment.

Nymex reformulated gasoline blendstock--the benchmark gasoline

contract--fell 0.1% to $1.64 a gallon. ICE gas oil changed hands at

$491.25 a metric ton, UP $3.00 from the previous settlement.

Write to Sarah McFarlane at sarah.mcfarlane@wsj.com and Biman

Mukherji at biman.mukherji@wsj.com

(END) Dow Jones Newswires

August 03, 2017 06:10 ET (10:10 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

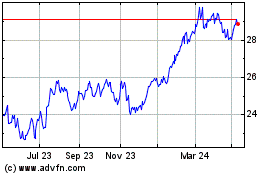

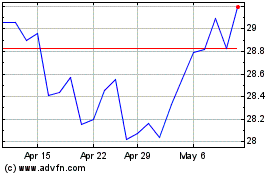

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Apr 2023 to Apr 2024