WorleyParsons to Buy AFW UK to Enter North Sea Market

09 October 2017 - 10:14AM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Australian engineering contractor

WorleyParsons Ltd. will enter the North Sea through a GBP228

million (US$298 million) deal to buy the majority of Amec Foster

Wheeler PLC's U.K. oil and gas operations.

WorleyParsons said Monday it will acquire AFW UK Oil & Gas

Ltd. for an enterprise value of GBP182 million, plus adjustments

for working capital and cash, which is expects will lifts its

earnings and lower debt gearing.

Buying AFW UK, which offers engineering and construction

services on the U.K. continental shelf, will accelerate

WorleyParsons' efforts to build a global business offering

maintenance, modifications and operations. AFW UK is being sold to

answer competition concerns raised with John Wood Group PLC's

planned GBP2.23 billion takeover of rival Amec Foster Wheeler.

WorleyParsons said AFW UK has maintainable revenue of about

GBP350 million and earnings before interest, tax, depreciation and

amortization of GBP20 million a year.

To help fund the deal, the Australian company will raise 322

million Australian dollars (US$250.1 million) by issuing new stock

via a discounted 1-for-10 share offer.

"We are excited to enter the U.K. North Sea market as a leading

player based in Aberdeen," WorleyParsons Chief Executive Andrew

Wood said.

The acquisition is expected to benefit earnings per share in the

first year of ownership, and reduce debt-to-ebitda to 2.2 times

from 2.4, the company said.

WorleyParsons has hired UBS AG as its financial adviser on the

acquisition and lead manager of the share offer.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

October 08, 2017 18:59 ET (22:59 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

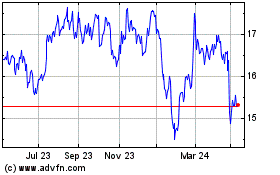

Worley (ASX:WOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Worley (ASX:WOR)

Historical Stock Chart

From Apr 2023 to Apr 2024