By Robb M. Stewart in Melbourne and Dave Michaels in Washington

A U.S. lawsuit alleging Rio Tinto PLC misled investors about the

value of its assets in Mozambique is the second serious regulatory

problem in less than a year to rock the mining giant over its

forays in Africa.

The world's second-largest independent mining company was

already grappling with multiple investigations in the U.S., U.K.

and Australia into a $10.5 million payment made to a consultant to

help it acquire rights to a large iron-ore deposit in Guinea known

as Simandou. That revelation forced the departure last November of

Rio Tinto's energy and minerals chief and a legal and regulatory

affairs executive.

On Wednesday, allegations that the British-Australian company

misled investors over its Mozambique coal assets forced its former

chief financial officer, Guy Elliott, to resign from the board of

Royal Dutch Shell PLC. The U.S. Securities and Exchange Commission

is seeking to bar Mr. Elliott and former Rio Tinto Chief Executive

Thomas Albanese from serving as officers or directors of a public

company.

Rio Tinto continued to value the mining assets in Mozambique at

more than $3 billion despite an internal assessment that they were

worth negative $680 million, according to a SEC lawsuit filed this

week in Manhattan federal court.

The SEC is pursuing civil financial penalties and disgorgement

of ill-gotten gains through its lawsuit. Separately, Rio Tinto

agreed to pay GBP27 million ($36 million) to settle claims by the

U.K. Financial Conduct Authority that the company didn't write down

the value of the Mozambique mine in a timely manner.

Rio Tinto said Tuesday that the SEC's claims of fraud are

"unwarranted" and would be proven wrong in court. Mr. Albanese said

he is innocent of any wrongdoing and that the SEC's claims "will be

proved baseless." A spokeswoman for Mr. Elliott said he also

disputes the SEC's charges and will fight them.

Shell said Wednesday that Mr. Elliott stood down over "his

involvement in legal proceedings regarding his former employment at

Rio Tinto" and that he would like to be considered for rejoining

its board once the issue was resolved.

Rio Tinto's shares were down about 1.2% in afternoon trading in

London. Tyler Broda, a mining analyst at RBC Capital Markets, said

the revelations were unlikely to significantly affect Rio Tinto's

share price.

"It will likely cause more noise around Rio's corporate culture,

especially on the back of the Simandou bribery charges from last

year," Mr. Broda said in a note. Rio Tinto says it is cooperating

with all probes into the Simandou case.

The Mozambique and Guinea cases ramp up scrutiny of Rio Tinto's

actions under Mr. Albanese, who resigned in 2013 after the company

announced it was writing down the value of assets around the world

by $14 billion, including $3 billion in Mozambique, as commodity

prices began to fall.

Rio Tinto sold the Mozambique coal business in 2014 for $50

million, or about 2% of what it paid, the SEC said.

The $14 billion figure included a huge impairment on the value

of Alcan Inc., an aluminum processing company that Rio Tinto

acquired in 2007.

The SEC alleged that Messrs. Albanese and Elliott didn't

disclose the problems with the Mozambique assets because they had

already written down the value of Alcan and feared the market's

reaction to another unsuccessful deal.

The project hit several major setbacks, including the Mozambique

government's rejection of transport plans for the coal. The company

knew by the end of 2011 that it could sell only about 5% of the

coal that it had originally assumed, the SEC alleged.

The company later raised $3 billion through debt sold to

investors without revealing the problems with the Mozambique

assets, the SEC said.

In Guinea, internal emails reviewed by The Wall Street Journal

showed that high-level executives including Mr. Albanese approved

the payment in 2011 to a consultant who was close to senior Guinean

government officials.

The emails, which were reviewed by The Wall Street Journal, show

Rio executive Alan Davies asking permission from the company's

then-iron-ore chief, Sam Walsh, to make the payments to François de

Combret, a former Lazard Ltd. managing director.

Mr. de Combret had been helping the company negotiate with the

Guinean government to retain an iron-ore concession in the

country's Simandou mountain range, according to Mr. Davies's email,

and his services "were of the most unique nature," including

helping the company's communications with Guinea's president, Alpha

Condé. Mr. Condé was at the time being advised by Mr. de Combret, a

friend he had met in school in Paris, according to a person

familiar with the matter.

Mr. Walsh, who was Rio Tinto's iron ore chief at the time,

checked the idea with Mr. Albanese, the company's then-chief

executive, who gave the green light but warned Mr. Walsh to "think

of the optics to the [government of Guinea.]," according to the

emails. Mr. Walsh later served as CEO from 2013 to 2016.

Mr. Davies has denied wrongdoing. This year he was named CEO of

Moxico Resources PLC, a copper mining company with assets in

Zambia. A Moxico representative didn't immediately respond do a

request for comment.

Attempts to reach Messrs. Walsh and de Combret have been

unsuccessful and they haven't publicly commented on the issue.

--Scott Patterson in London contributed to this article.

Write to Robb M. Stewart at robb.stewart@wsj.com and Dave

Michaels at dave.michaels@wsj.com

(END) Dow Jones Newswires

October 18, 2017 09:53 ET (13:53 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

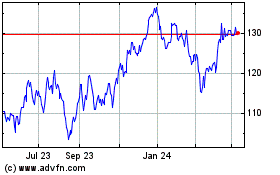

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

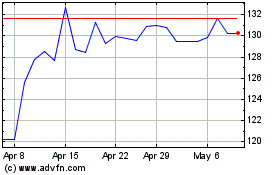

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024