Novartis to Pay $3.9 Billion for Radio-Pharmaceuticals Firm -- Update

31 October 2017 - 12:00AM

Dow Jones News

By Denise Roland

Novartis AG has agreed to acquire Advanced Accelerator

Applications SA for $3.9 billion, a deal that would boost its

oncology portfolio as generic competition eats into sales of

blockbuster blood-cancer drug Gleevec.

The Swiss drug giant said Monday it is offering $41 a share in

cash for the France-based, New York-listed company, which has

recommended the deal to its shareholders.

A deal would hand Novartis AAA's recently-approved Lutathera

treatment, which belongs to a small but growing class of therapies

known as radio-pharmaceuticals. Such treatments carry radioactive

substances directly to tumor cells, allowing them to attack the

cancer at close range.

Lutathera targets gastroenteropancreatic neuroendocrine tumors,

a rare form of cancer that occurs in the gut and pancreas. It was

shown to significantly increase the chances of survival in patients

with neuroendocrine tumors that couldn't be removed surgically,

when compared with the standard hormone therapy.

The European Medicines Agency gave Lutathera the nod in

September, while the Food and Drug Administration is expected to

make a decision on the treatment in January.

The treatment is unlikely to become a blockbuster: analysts at

Citi estimate Lutathera will generate sales of around $500 million

a year at its peak. But it would still help strengthen Novartis's

oncology business, which is under pressure after Gleevec, a blood

cancer drug that generated nearly $5 billion a year, lost patent

protection in 2016.

Novartis is also counting on new drug launches in other disease

areas to offset Gleevec's decline. The two most important of these

are Cosentyx for psoriasis and certain rheumatoid conditions and

Entresto for heart failure.

Bruno Strigini, head of Novartis Oncology, said the acquisition

would allow the company to expand the global reach of Lutathera.

Novartis already sells a drug called Afinitor that treats a range

of cancers including neuroendocrine tumors.

Mr. Strigini also said the acquisition would allow Novartis to

build on AAA's technology platform. AAA is in the early stages of

developing radio-pharmaceuticals for other types of cancer,

including prostate and breast.

Novartis isn't the only large drugmaker to place a bet on

radio-pharmaceuticals. Germany's Bayer AG already sells a product

called Xofigo that irradiates bone metastases in prostate cancer

patients who don't respond to hormone therapy. Bayer is currently

testing the same treatment in various other cancer types.

Novartis, which will fund the acquisition with debt, said the

deal is subject to the approval of regulators and at least 80% of

AAA's shares being tendered.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

October 30, 2017 08:45 ET (12:45 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

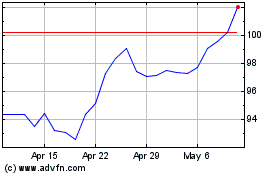

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

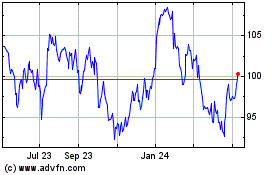

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024