Advanced Accelerator Applications S.A.

(NASDAQ:AAAP) (AAA or the Company), a leader in nuclear medicine

theragnostics, today announced that a direct and indirect

subsidiary of Novartis AG (NYSE:NVS), Novartis Groupe France S.A.,

a société anonyme organized under the laws of France (“Purchaser”),

has commenced a cash tender offer to purchase all of the

outstanding ordinary shares, nominal value €0.10 per share (each,

an “Ordinary Share,” and collectively, the “Ordinary Shares”),

including Ordinary Shares represented by American Depositary Shares

(each of which represents two Ordinary Shares) (each, an “ADS,” and

collectively, the “ADSs,” and, together with the Ordinary Shares,

the “Company Shares”), of AAA, for a price of US $41.00 per

Ordinary Share and US $82.00 per ADS, in each case, payable net to

the seller thereof in cash, without interest, less any withholding

taxes that may be applicable (the “Offer”). The Offer is

being made upon the terms and subject to the conditions set forth

in the Offer to Purchase, dated December 7, 2017 (the “Offer to

Purchase”), the accompanying Ordinary Share Acceptance Form and ADS

Letter of Transmittal, and pursuant to the terms of the previously

announced Memorandum of Understanding, dated as of October 28,

2017, by and between Novartis and AAA, as amended on December 5,

2017 (the “MoU”).

The Offer will expire at 12:00 midnight, New

York City time, on January 19, 2018, unless extended (the latest

time and date at which the Offer will expire, the “Expiration

Date”). Any extension of the Offer will be followed by public

announcement of the extension by press release or other public

announcement no later than 9:00 a.m., New York City time, on

the next business day after the Expiration Date.

Novartis has filed a Tender Offer Statement on

Schedule TO with the United States Securities and Exchange

Commission (the “SEC”). The Offer to Purchase contained within the

Schedule TO sets out the terms and conditions of the

Offer.

AAA has also filed a Solicitation/Recommendation

Statement on Schedule 14D-9 (the “Schedule 14D-9”) with the SEC,

which includes, among other things, the recommendation of the AAA

board of directors that AAA’s shareholders accept the Offer and

tender all of their Company Shares pursuant to the Offer.

The Offer is subject to the satisfaction or

waiver of certain conditions, including (i) immediately prior to

the expiration of the Offer (as extended in accordance with the

MoU), the number of Ordinary Shares (including Ordinary Shares

represented by ADSs) validly tendered pursuant to the Offer (and

not properly withdrawn prior to the expiration of the Offer),

together with the Ordinary Shares then beneficially owned by

Novartis or Purchaser (if any), represents at least 80% of (a) all

of the Ordinary Shares (including Ordinary Shares represented by

ADSs) then outstanding (including any Ordinary Shares held in

escrow), plus (b) all of the Ordinary Shares issuable upon the

exercise, conversion or exchange of any options, warrants,

convertible notes, stock appreciation rights, or other rights to

acquire Ordinary Shares then outstanding, regardless of whether or

not then vested, plus (c) any Ordinary Shares issuable pursuant to

the existing arrangement with the former shareholders of

BioSynthema Inc., (ii) the receipt of approvals from applicable

regulatory authorities, including the expiration or termination of

the applicable waiting period under the Hart-Scott-Rodino Antitrust

Improvements Act of 1976, as amended, (iii) the non-existence of

certain types of judgments, decisions, orders, or other

authoritative measures that could impede the consummation of the

Offer, and (iv) the absence of a Material Adverse Effect (as

defined in the MoU) with respect to AAA and its subsidiaries.

As more fully described in the Schedule TO, in determining whether

the 80% condition has been met, the aggregate amount of shares

underlying stock options and warrants that have been exercised

pursuant to the cashless exercise facility established with Banque

Transatlantique S.A., and for which instructions to tender such

shares into the subsequent offer period have been received by

Banque Transatlantique S.A. and have not been withdrawn prior to

the Expiration Date, will be included in the calculation of the

number of shares validly tendered pursuant to the Offer. The

Offer is subject to other important conditions set forth in the

Offer to Purchase. The Offer is not subject to a financing

condition.

Innisfree M&A Incorporated is acting as

information agent for Novartis in the Offer. The Bank of New

York Mellon is acting as the depositary and tender agent for the

ADSs in the Offer, and Banque Transatlantique S.A. is acting as the

centralizing, paying and transfer agent for the Ordinary Shares in

the Offer. Requests for documents and questions regarding the

relating to the Offer may be directed to Innisfree M&A

Incorporated by telephone at (888) 750-5834 (toll free).

Holders outside the U.S. and Canada should call Lake Isle M&A

Incorporated, a wholly-owned subsidiary of the Innisfree M&A

Incorporated, at +44-20-7710-9960.

About Advanced Accelerator Applications

S.A.

Advanced Accelerator Applications (NASDAQ:AAAP)

is an innovative radiopharmaceutical company developing, producing

and commercializing molecular nuclear medicine theragnostics. AAA’s

theragnostic platform is based on radiolabeling a targeting

molecule with either gallium Ga 68 for diagnostic use, or lutetium

Lu 177 for therapy. AAA’s first theragnostic pairing for

neuroendocrine tumors includes diagnostic drugs NETSPOT® in the US

and SomaKit TOC™ in Europe; and therapeutic USAN: lutetium Lu 177

dotatate/INN: lutetium (177Lu) oxodotreotide (LUTATHERA®), which is

approved for use in Europe and currently under review with the FDA.

Additional theragnostics in development target gastrointestinal

stromal tumors (GIST), and prostate and breast cancer. AAA is also

an established leader in molecular nuclear diagnostic

radiopharmaceuticals for PET and SPECT, mainly used in clinical

oncology, cardiology and neurology. Headquartered in

Saint-Genis-Pouilly, France, AAA currently has 21 production and

R&D facilities, and more than 600 employees in 13 countries

(France, Italy, the UK, Germany, Switzerland, Spain, Poland,

Portugal, The Netherlands, Belgium, Israel, the US and Canada). AAA

reported sales of €109.3 million in 2016 (+23% vs. 2015) and €106.4

million for the first 9 months of 2017 (+31% vs. first 9 months of

2016). AAA is listed on the Nasdaq Global Select Market under the

ticker “AAAP”. For more information, please visit:

www.adacap.com.

Additional Information

This announcement is for informational purposes

only and is neither an offer to purchase nor a solicitation of an

offer to sell securities. On December 7, 2017, Purchaser and

Novartis filed a Tender Offer Statement on Schedule TO with the SEC

and AAA filed the Schedule 14D-9 with the SEC, in each case with

respect to the Offer. The Tender Offer Statement (including

the Offer to Purchase, accompanying Ordinary Share Acceptance Form

and American Depositary Receipts letter of transmittal and other

offer documents) and the Solicitation/Recommendation Statement

contain important information that should be read carefully before

any decision is made with respect to the Offer. Those

materials and all other documents filed by, or caused to be filed

by, Novartis, Purchaser or AAA with the SEC will be available at no

charge on the SEC’s website at www.sec.gov. The

Schedule TO Tender Offer Statement and related materials may

be obtained for free under the “Investors—Financial Data” section

of Novartis website at

https://www.novartis.com/investors/financial-data/sec-filings. The

Schedule 14D-9 and such other documents may be obtained for

free from the Company under the “Investor Relations” section of the

Company's website at http://investorrelations.adacap.com/.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains forward-looking

statements. All statements, other than statements of historical

facts, contained in this press release, including statements

regarding the Company's strategy, future operations, future

financial position, future revenues, projected costs, prospects,

plans and objectives of management, are forward-looking statements.

The words "anticipate," "believe," "estimate," "expect," "intend,"

"may," "plan," "predict," "project," "target," "potential," "will,"

"would," "could," "should," "continue," and similar expressions are

intended to identify forward-looking statements, although not all

forward-looking statements contain these identifying words.

Forward-looking statements that appear in a number of places in

this press release include the Company's current expectation

regarding future events and various matters, including the

transaction, expected timing of filings with the FDA and EMA, and

approval dates. These forward-looking statements involve risks and

uncertainties that may cause actual results, events or developments

to be materially different from any future results, events or

developments expressed or implied by such forward-looking

statements. Such factors include, but are not limited to, the

ability of the parties to complete the transaction on a timely

basis or at all, changing market conditions, the successful and

timely completion of clinical studies, the timing of our submission

of applications for regulatory approvals, EMA, FDA and other

regulatory approvals for our product candidates, the occurrence of

side effects or serious adverse events caused by or associated with

our products and product candidates; our ability to procure

adequate quantities of necessary supplies and raw materials for

USAN: lutetium Lu 177 dotatate/INN: lutetium (177Lu) oxodotreotide

(LUTATHERA®) and other chemical compounds acceptable for use in our

manufacturing processes from our suppliers; our ability to organize

timely and safe delivery of our products or product candidates by

third parties; any problems with the manufacture, quality or

performance of our products or product candidates; the rate and

degree of market acceptance and the clinical utility of USAN:

lutetium Lu 177 dotatate/INN: lutetium (177Lu) oxodotreotide

(LUTATHERA®) and our other products or product candidates; our

estimates regarding the market opportunity for USAN: lutetium Lu

177 dotatate/INN: lutetium (177Lu) oxodotreotide (LUTATHERA®), our

other product candidates and our existing products; our

anticipation that we will generate higher sales as we diversify our

products; our ability to implement our growth strategy including

expansion in the US; our ability to sustain and create additional

sales, marketing and distribution capabilities; our intellectual

property and licensing position; legislation or regulation in

countries where we sell our products that affect product pricing,

taxation, reimbursement, access or distribution channels;

regulatory actions or litigation; and general economic, political,

demographic and business conditions in Europe, the US and

elsewhere. Except as required by applicable securities laws, we

undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Contacts:

AAA Corporate Communications Rachel

LevineDirector of Communications rachel.levine@adacap.comTel: +

1-212-235-2395

AAA Investor Relations Jordan Silverstein Head

of Investor Relations jordan.silverstein@adacap.com Tel: +

1-212-235-2394

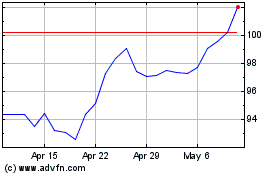

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

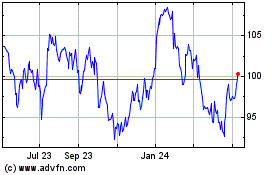

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024