Australian Dollar Climbs After Upbeat China Data

02 January 2018 - 1:08PM

RTTF2

The Australian dollar strengthened against its most major rivals

in the Asian session on Tuesday, as a data showed that China's

manufacturing activity expanded at the fastest pace in four months

in December.

Survey data from IHS Markit showed that the Caixin Purchasing

Managers' Index for the factory sector rose to 51.5 in December

from 50.8 in November.

China is the biggest trading partner of Australia and a robust

indicator is positive for economy.

Sentiment was also boosted after North Korean leader Kim Jong Un

said he is open to talks with South Korea.

The aussie spiked up to a 2-1/2-month high of 0.7843 against the

greenback and more than a 2-month high of 88.41 against the yen,

from its early 4-day lows of 0.7795 and 87.83, respectively. The

next possible resistance for the aussie is seen around 0.795

against the greenback and 90.00 against the yen.

The aussie reversed from an early low of 0.9784 against the

loonie and an 11-day low of 1.5409 against the euro, rising to a

5-day high of 0.9828 and a 4-day high of 1.5323, respectively. If

the aussie rises further, it may find resistance around 0.99

against the loonie and 1.52 against the euro.

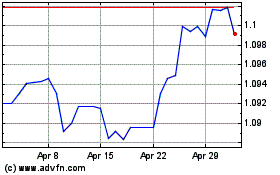

The aussie firmed to near a 4-week high of 1.1021 against the

kiwi and held steady thereafter. The pair finished Monday's trading

at 1.0984.

Looking ahead, PMIs from major European economies are due in the

European session.

In the New York session, Markit's U.S. final manufacturing PMI

for December is set for release.

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

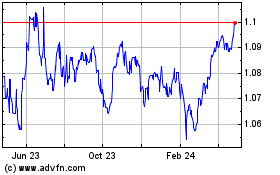

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024