Australian, NZ Dollars Climb Amid Rising Risk Appetite

04 January 2018 - 1:22PM

RTTF2

The Australian and the New Zealand dollars climbed against their

major opponents in late Asian deals on Thursday amid rising risk

appetite, as most Asian markets rose following the record closing

highs overnight on Wall Street and as China service sector growth

beat forecasts.

The latest survey from Caixin showed that China services sector

activity continued to expand in December, and at an accelerated

pace, with a PMI score of 53.9.

That's up from 51.9 in November, and it moves further above the

boom-or-bust line of 50 that separates expansion from

contraction.

Strong U.S. manufacturing and construction data coupled with the

Fed minutes showing a continued support for a gradual rate hike

aided sentiment.

Crude prices remained firm on lingering concerns over protests

in Iran, OPEC's third-biggest oil producer.

On the economic front, the latest survey from the Australian

Industry Group showed that the services sector in Australia

continued to expand in December, and at an accelerated pace, with a

Performance of Service Index score of 52.0.

That's up from 51.7 in November, and it moves further above the

boom-or-bust line of 50 that separates expansion from

contraction.

On Wednesday, the aussie was higher against its major rivals,

excepting the greenback. The kiwi was steady against the greenback

and the yen, but higher against the euro.

The aussie reversed from an early low of 0.9809 against the

loonie, rising to 0.9829. If the aussie rises further, 1.00 is

possibly seen as its next resistance level.

The Australian unit hit a 2-day high of 88.34 against the yen,

after having fallen to 88.08 at 5:45 pm ET. The aussie is seen

finding resistance around the 89.5 area.

Survey from Nikkei showed that Japan's manufacturing sector

continued to expand in December, and at an accelerated pace, with a

manufacturing PMI score of 54.0.

That's up from 53.6 in November, and it moves further above the

boom-or-bust line of 50 that separates expansion from

contraction.

The aussie advanced to 0.7842 against the greenback and 1.5326

against the euro, reversing from its prior lows of 0.7814 and

1.5367, respectively. The aussie is likely to challenge resistance

around 0.795 versus the greenback and 1.52 versus the euro.

The kiwi bounced off to 1.6904 against the euro and 1.1025

against the aussie, from its early lows of 1.6975 and 1.1051,

respectively. The next possible resistance for the kiwi is seen

around 1.68 against the euro and 1.09 against the aussie.

The NZ currency climbed to 2-day highs of 0.7113 against the

greenback and 80.08 against the yen, off its previous lows of

0.7073 and 79.74, respectively. Continuation of the kiwi's uptrend

may see it challenging resistance around 0.73 against the greenback

and 82.00 against the yen.

Looking ahead, U.K. mortgage approvals and money supply for

November and PMIs from major economies are set for release in the

European session.

At 8:15 am ET, ADP private payrolls for December are due.

In the New York session, U.S. weekly jobless claims for the week

ended December 30, Markit's services PMI for December and Canada

industrial product price index for November are slated for

release.

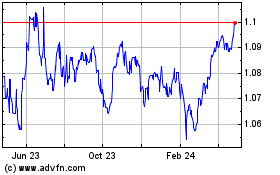

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

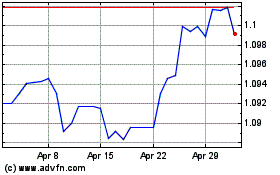

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024