Biogen: 5 More Cases Of Brain Infection In Tysabri Patients

18 November 2010 - 5:23AM

Dow Jones News

Biogen Idec Inc. (BIIB) disclosed five more cases of a rare

brain infection in multiple sclerosis patients on Tysabri, which it

sells with Elan Corp. (ELN), bringing the total number of cases to

75 as of Nov. 2.

The Weston, Mass., biotech company also reported an additional

death among patients that have developed the infection--known as

progressive multifocal leukoencephalopathy, or PML--a number that

is now 15.

The number of PML cases is important because if the infection

rate climbs too high, the drug's sales growth may drop. Regulators

have said that they watch the cases, but have concluded that the

benefits of the medicine to MS patients outweigh the risks.

The overall global PML rate is about 0.96 per 1,000 patients, a

company spokeswoman said, which still falls within the 1-in-1,000

rate previously seen in clinical trials and implied on the drug's

label. But the rate has been rising, and multiple Wall Street

analysts raised concern about the trend on Wednesday as the MS

market is becoming increasingly competitive.

"Given this PML rate increase, we expect it to cross the 1/1000

incidence threshold sometime during the next two months," Barclays

Capital analyst Jim Birchenough said in a note to clients.

Food and Drug Administration officials weren't immediately

available for comment.

Sales of Tysabri are important to the future growth of Biogen

and Elan. There is hope that the development of a blood test may

better determine the chances of patients contracting PML. Although

the overall risk of the infection is small, the test may make

patients and physicians more comfortable with using the drug.

Tysabri is considered to be a highly effective therapy for

multiple sclerosis, but its growth has been stunted by concerns

about PML. The drug was temporary withdrawn from the market

beginning in 2005 and relaunched in 2006 with a strict access plan

that monitors every patient using the drug.

Meanwhile, the MS treatment market is getting increasingly

competitive, something that Wall Street believes could put some

pressure on Tysabri and Biogen as a whole. Biogen get most of its

revenue from MS treatments Avonex and Tysabri, and hasn't launched

a new drug since the approval of Tysabri in 2004.

Novartis AG's (NVS) Gilenya, the first oral therapy for the

disease, was recently approved, and numerous other therapies are in

development.

Earlier this month, Biogen unveiled a sweeping restructuring

plan that cuts costs--including facility closings and layoffs--and

focuses the company on developing neurology treatments and

defending its current franchise of MS drugs.

The moves came after a business review by new Chief Executive

George Scangos, who joined the company in July.

As of Sept. 30, 55,100 patients were using the drug around the

world. In total, about 75,500 patients have used the drug since its

launch.

Of the total PML cases, 33 were in the U.S., 38 were in the

European Union and four were in other areas.

The risk of the infection increases with the number of monthly

infusions that a patient receives, but that rate appears to drop

after 30 months of use. Biogen views the drop as inconclusive,

because there aren't enough patients at the longer duration to have

enough confidence in that finding.

The most recent data update translates to a rate of 1.49 cases

per 1,000 for patients on the drug for a year or longer, but rises

to 1.97 per 1,000 for those on the drug for two years or

longer.

Looked at another way, the rate is about 1.49 cases per 1,000

patients on the drug for between two and three years. The incidence

is about 0.37 case per 1,000 patients in those using it for one to

two years, and it is essentially nonexistent in patients using it

for less than a year.

-By Thomas Gryta, Dow Jones Newswires; 212-416-2169;

thomas.gryta@dowjones.com

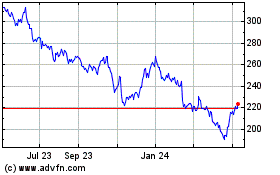

Biogen (NASDAQ:BIIB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Biogen (NASDAQ:BIIB)

Historical Stock Chart

From Apr 2023 to Apr 2024