Wouldn’t we all like to know how Brexit will pan out. As I write, no one has a clue how it’s going to unfold but the situation is hardly likely to improve even if there is a hard Brexit, soft Brexit, further referendum or any one of the number of permutations that stretch out before us.

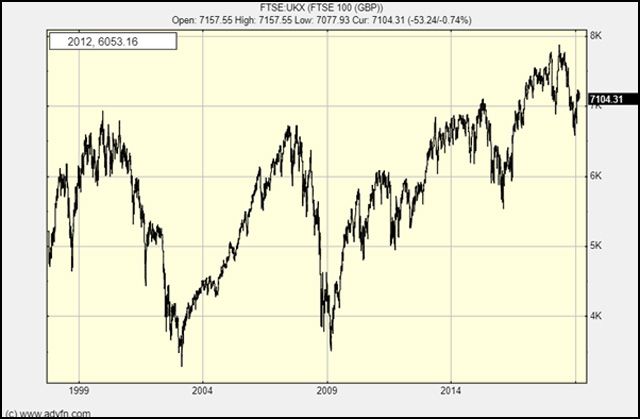

One thing is certain, well at least up to a point, and that is what has happened. Whilst firmly in the EU – for the last 20 years – the FTSE has gone nowhere.

20 years is a long time to make 100 FTSE points. It’s a miserable performance, especially when you look at the US.

With this Provider you can trade CFD’s on the FTSE100.

Account opening in 15 minutes. Deposits by credit card or PayPal possible.

80.6% of retail CFD accounts lose money.

Clearly the UK hasn’t recovered from the so called ‘Global Financial Crisis’ or ‘credit crunch’ as I like to keep calling it.

However you like to explain it, being in Europe hasn’t exactly been a boon, at least not for the stock market.

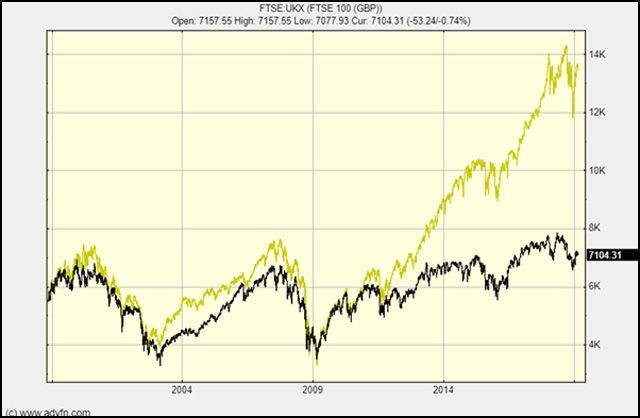

You can see from the next chart that the UK and France are twin laggards and the US and Germany are stars of the same dynamic.

Clearly the US and Germany have something in common and so do the UK and France. Whatever it is, it’s not Europe.

My second observation is that if nothing changes why would this economic performance? Clearly both France and the UK are both delivering economic outcomes in the second division. Remaining in Europe can only support this status quo. Europe is, after all, a giant status quo; this is what a superstate is all about.

Obviously, many will want to trade the event of Brexit, but it would be kind of amazing if that wasn’t in the price. However, a no-deal Brexit isn’t yet priced in because no one believes it will happen.

If it does, then buy that dip. After trading that, wait for the market to settle and look to take some medium- to long-term positions on good, cheap companies.

The market will price in the next gritty couple of years pretty quickly and then the only way is up.

If the politicians get their way and the UK stays in Europe, expect nothing but more of the same.

With this Provider you can trade CFD’s on the FTSE100.

Account opening in 15 minutes. Deposits by credit card or PayPal possible.

Incidentally, Plus500 offers deposit by credit card and PayPal, as well as a very fast account opening.

80.6% of retail accounts lose money on CFD Trading with this provider. You should consider whether you can afford to take the high risk of losing your money.

Clem Chambers is CEO of ADVFN, Europe’s largest stock trading community. He is winner of the State Street Journalist of the year 2018 (Market Commentary) and twice nominated Print Publishers Association columnist of the year.

Hot Features

Hot Features