London open: Stocks edge up ahead of non-farm payrolls

London stocks edged up in early trade on Friday ahead of the release of the US non-farm payrolls report and as investors mulled the outcome of the latest round of trade talks in Washington.

At 0820 GMT, the FTSE 100 was up 0.2% at 7,416.32, while the pound was 0.1% firmer against the dollar and the euro at 1.3093 and 1.1663, respectively.

US President Trump said on Thursday after a meeting with Chinese vice Premier Liu He that a trade deal between the two nations was about four weeks away, with some sticking points remaining. Trump said the two sides had agreed “a lot of the most difficult points” but still had some way to go.

On home turf, meanwhile, Theresa May and her team were due to hold another round of talks with Labour following four and a half hours of discussions on Thursday, in a bid to break the Brexit deadlock. Both the prime minister and Labour leader Jeremy Corbyn are receiving conflicting calls within their own parties about the possibility of a second Brexit referendum.

This comes as the president of the European Council, Donald Tusk, suggested a flexible 12-month delay to Article 50 with an option to leave the EU once the withdrawal agreement is ratified by parliament.

According to reports, May will write to Tusk on Friday to request a further delay to Brexit beyond the current 12 April deadline.

The big focus on the macroeconomic front will be the US non-farm payrolls report, with unemployment numbers and average earnings figures due out in the US at 1330 BST.

Payrolls are expected to have risen by around 180,000 following a very weak release in February, which showed an increase of just 20,000.

CMC Markets analyst David Madden said: “The pitiful number in the last report might be a sign of weakness in the US economy, or it might be an indication the US labour market is tightening, and employers should offer higher wages in order to fill vacancies.

The unemployment rate is expected to hold steady at 3.8% and annual average earnings are tipped to remain at 3.4%, or 0.3% on a monthly basis, down from 0.4% in February.

“The earnings component of the report has become more important lately as US workers who earn more, are more likely to spend more,” said Madden. “Also, a high earnings number could be construed that the labour market is tight, and that employers need to offer higher wages in order to attract staff.”

In UK corporate news, GVC Holdings was in the green after saying it grew online gaming revenues at double-digit rates in the first quarter while its Ladbrokes bookmaking shops were flat ahead of the crackdown on fixed-odds betting machines that began on 1 April.

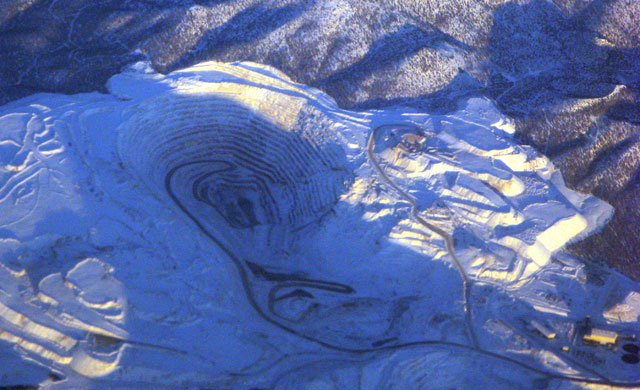

Iron ore pellet maker Ferrexpo also gained despite saying that first quarter production fell to 2.53m tonnes from 2.58m a year earlier.

Engineering and industrial software provider Aveva ticked up as it agreed to buy the software assets of MaxGrip, one of its partners since 2017, which optimises asset performance with reliability-centred maintenance solutions.

Power generator ContourGlobal nudged up as it posted a 19% jump in 2018 earnings, boosted by acquisitions, and announced the appointment of Stefan Schellinger – former finance director of plastic and fibre products supplier Essentra – as its new chief financial officer

In broker note action, shares in British Gas owner Centrica were knocked lower by a downgrade to ‘add’ at AlphaValue.

Stagecoach was hit by a downgrade to ‘underperform’ at Jefferies, while Dunelm was a little weaker after a downgrade to ‘add’ at Peel Hunt.

Countrywide was lifted to ‘buy’ from ‘hold’ at Berenberg, which also upped Foxtons to ‘hold’ from ‘sell’ and double-downgraded Purplebricks to ‘sell’ from ‘buy’.

Hot Features

Hot Features