Schlumberger to Exit Land, Marine Seismic Acquisition Business

20 January 2018 - 1:17AM

Dow Jones News

By Imani Moise

Oil-services giant Schlumberger Ltd. (SLB) said it will exit the

marine and land seismic acquisition market and transform its

WesternGeco product line into an asset-light business over concerns

about future returns.

Seismic acquisition involves generating and recording data about

the composition of rocks or fluid content deep underground.

Schlumberger recorded a $198 million impairment charge on its

seismic data operation in the third quarter.

WesternGeco is a part of the company's Reservoir

Characterization Group, where fourth-quarter revenue declined 8%

sequentially and 2% from the prior year.

"The only product line that does not meet our return

expectations going forward, even factoring in an eventual market

recovery, is our seismic acquisition business," Chief Executive

Paal Kibsgaard said.

Shares fell 2.2% to $74.68 during premarket trading. The stock

is down 12% over the past 12 months.

Write to Imani Moise at imani.moise@wsj.com

(END) Dow Jones Newswires

January 19, 2018 09:02 ET (14:02 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

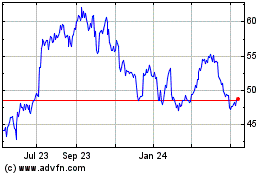

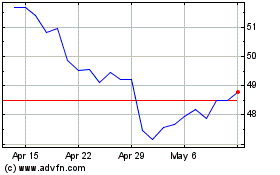

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Apr 2023 to Apr 2024