Proxy Fights Are a Rarity for Peltz's Trian--2nd Update

18 July 2017 - 6:36AM

Dow Jones News

By David Benoit

Trian Fund Management LP doesn't wage proxy fights often, but

when it does, it goes big.

The activist investor launched a campaign Monday to get

co-founder Nelson Peltz elected to the board of Procter &

Gamble Co. Worth $222 billion, P&G is the largest company to

ever face such a campaign.

Because of P&G's size, Trian's ability to win support from

other investors will be in a particularly bright spotlight, and it

will have to convince them that its brand of activism can help

companies and not distract from work already being done. P&G

rejected naming Mr. Peltz to the board and said in a statement it

"is confident that the changes being made are producing

results."

Typically, Trian has tried to avoid the perception it fights

companies. It has branded itself as a "highly engaged shareholder,"

not an activist, but instead a sort of uber-adviser to executives

and boards. It seeks a board seat at nearly all of its companies so

that it can tap the "perfect information" only insiders have and

can change the discussion about what is working and what isn't.

Trian's performance lately has lagged behind broader markets. A

major Trian fund is up 1.5% through the first week in July,

according to an investor document, dragged down by a 15% slump in

General Electric Co. this year, and a recent drop in food

distributor Sysco Corp. after Amazon.com Inc. announced its plan to

buy Whole Foods Market Inc. The S&P 500 index, meanwhile, rose

9.3% through June and an index of activist funds tracked by HFR

Inc. rose 4.2% in the same time frame.

Trian says its presence helps companies grow their earnings and

stock price more than average. Of the boards Mr. Peltz has joined,

the companies have averaged annual returns that best the S&P

500 by 8.8 percentage points, Trian said in a presentation.

Trian's willingness to work with companies in private has often

led it to negotiate its way into the board instead of needing a

fight. Since it started in 2005, it has only had two prior proxy

fights -- with H.J. Heinz Co. and DuPont Co. -- and there were

nearly 10 years between them.

In 2006, it took a stake in Heinz and sought a seat on the

ketchup giant's board. That led to a heated fight, an early example

of a shareholder taking on an American icon that helped open the

floodgates of activism. Trian won two seats on that board,

including one for Mr. Peltz. Afterward, the sides grew close and

Heinz CEO William Johnson was put on the board of PepsiCo Inc. by

Trian.

The victory worked as something of a stamp of legitimacy for

nearly a decade: Trian would go on to take big stakes, and

companies, including Bank of New York Mellon Corp. and

Ingersoll-Rand PLC, would often quickly assent to giving the firm a

board seat.

At Bank of New York Mellon, Trian co-founder Ed Garden joined

the board in 2014, one of the few activists to join a heavily

regulated bank. The sides have publicly lauded each other and

worked together to cut costs, and the stock has returned 38% since

Mr. Garden joined the board, in line with the KBW Bank Index.

Monday, the bank named a new chief executive, Charles Scharf.

In 2015, Trian ran a fight against DuPont. At the time, a win by

Trian would have made DuPont the largest company ever to lose a

shareholder vote, but it waged a successful countercampaign. DuPont

argued Trian would be "shadow management" in the boardroom and said

it didn't need Trian because its board had proven it was willing to

make changes on its own.

Though Trian lost that fight, the vote was close enough that if

any single large investor had flipped it would have won a seat. And

within months, DuPont missed on its quarterly results, changed its

CEO and opened back up to Trian helping it structure its pending

merger with Dow Chemical Co.

P&G seems ready to make a similar case to DuPont's: CEO

David Taylor only started in November 2015 and has been moving to

turn the gigantic organization. The board backs his plan and

doesn't want to add Mr. Peltz because it doesn't see the need,

people familiar with the matter said. The board also rejected

Trian's concerns Mr. Taylor wouldn't deliver on pledged cost cuts,

arguing the fear was based on prior management.

Rob Copeland contributed to this article.

Write to David Benoit at david.benoit@wsj.com

(END) Dow Jones Newswires

July 17, 2017 16:21 ET (20:21 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

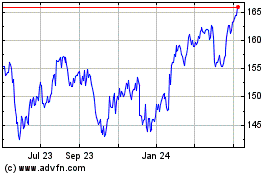

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

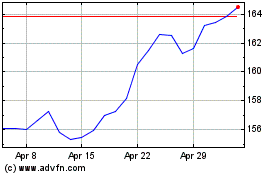

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024