HSBC to Pay $352 Million to Resolve French Probe -- Update

15 November 2017 - 4:00AM

Dow Jones News

By Brian Blackstone

ZURICH-- HSBC Holdings PLC said Tuesday that its Swiss

private-banking unit will pay EUR300 million ($352 million) to

resolve charges that it helped clients evade taxes in France.

"HSBC is pleased to resolve this legacy investigation which

relates to conduct that took place many years ago," the bank said

in a statement. "HSBC has publicly acknowledged historical control

weaknesses at the Swiss Private Bank on a number of occasions and

has taken firm steps to address them."

French prosecutors began investigating HSBC in 2014 as part of a

widening probe into whether the bank breached laws authorizing only

French-registered lenders to sign up customers in the country. The

investigation also examined whether the bank was complicit in

laundering the proceeds of any tax evasion.

According to a statement from the French prosecutors office

Tuesday, more than EUR1.6 billion worth of client assets were

shielded from French taxes. French authorities said they discovered

the assets after seizing computer documents found at the French

home of a former HSBC employee in 2009.

HSBC said that under the agreement announced Tuesday, there is

no finding of guilt on the part of the Swiss Private Bank. It has

provisioned fully for the amount.

The settlement was the first in France under a new law passed

last year modeled on U.S. deferred prosecution agreements.

Write to Brian Blackstone at brian.blackstone@wsj.com

(END) Dow Jones Newswires

November 14, 2017 11:45 ET (16:45 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

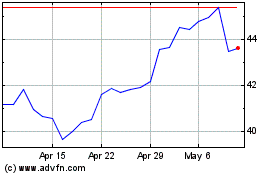

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

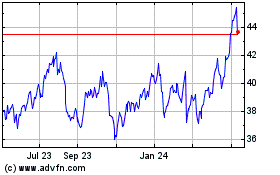

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024