U.S. Dollar Falls On Report Of China To Slow U.S. Bond Purchases

10 January 2018 - 7:23PM

RTTF2

The U.S. dollar declined against its major opponents in the

European session on Wednesday, following a media report that China

is considering slowing or halting new Treasury purchases for

foreign reserves.

Bloomberg reported that Chinese officials are reviewing their

stand on investment in U.S. government debt, given trade tensions

between Beijing and Washington as well as relatively lower

attractiveness for U.S. treasuries than other assets.

U.S. treasury yields spiked up following the news, with the

yield on 10-year U.S. Treasuries rising to a 10-month high of 2.588

percent in European trading.

China is the largest foreign investor in U.S. government debt,

holding U.S. securities worth $1.1892 trillion as of October,

2017.

The currency was higher against its major rivals in the Asian

session, with the exception of the yen.

Extending early slide, the greenback weakened to a 1-1/2-month

low of 111.27 against the yen, from a high of 112.78 hit at 7:00 pm

ET. The next possible support for the greenback is seen around the

110.00 region.

The greenback, having advanced to near a 2-week high of 1.3482

against the pound at 5:15 am ET, reversed direction and edged down

to 1.3562. If the greenback extends decline, 1.38 is likely seen as

its next support level.

Data from the Office for National Statistics showed that UK

industrial production climbed for the eighth straight month in

November driven by energy and manufacturing output.

Monthly growth in industrial output doubled to 0.4 percent from

0.2 percent in October. The rate came in line with expectations and

marked the eighth consecutive expansion.

The greenback slipped to 2-day lows of 1.2018 against the euro

and 0.9755 versus the franc, off its early high of 1.1923 and near

a 2-week high of 0.9846, respectively. Continuation of the

greenback's downtrend may see it challenging support around 1.23

against the euro and 0.96 against the franc.

Reversing from an early high of 1.2476 against the loonie, the

greenback dropped to 1.2428. The greenback is seen finding support

around the 1.23 area.

The greenback hit a 2-day low of 0.7866 against the aussie and a

3-1/2-month low of 0.7229 against the kiwi, from its early high of

0.7808 and a 6-day high of 0.7141, respectively. On the downside,

0.795 and 0.74 are likely seen as the next support levels for the

greenback against the aussie and the kiwi, respectively.

Looking ahead, U.S. import and export prices for December and

wholesale inventories for November as well as Canada building

permits for the same month are set for release in the New York

session.

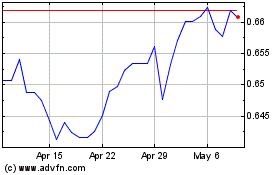

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024