Australian Dollar Climbs Amid Rising Risk Appetite

15 January 2018 - 1:37PM

RTTF2

The Australian dollar strengthened against its major

counterparts in the Asian session on Monday amid rising risk

appetite, as most Asian stocks rose following record highs from the

Wall Street on Friday, with a weaker U.S. dollar and higher

commodities prices lifting sentiment.

Investors became optimistic over global growth as encouraging

U.S. retail sales and inflation data as well as

better-than-expected quarterly earnings from some financial majors

spurred confidence in the global economy.

Data from the Melbourne Institute and TD Securities showed that

Australia's consumer prices increased 0.1 percent on month in

December, compared to a 0.2 percent gain in November.

The annual inflation rate slowed to 2.3 percent from 2.7 percent

last month.

The aussie hit a 4-day high of 1.0942 against the kiwi, compared

to Friday's closing value of 1.0908. The next possible resistance

for the aussie-kiwi pair is seen around the 1.105 region.

Figures from Statistics New Zealand showed that New Zealand's

food prices declined for the fourth straight month in December.

Food prices dropped 0.8 percent month-over-month in December,

faster than the 0.4 percent fall in November.

The aussie strengthened to 0.7961 against the greenback, its

highest since September 25, 2017. If the aussie rises further, 0.81

is possibly seen as its next resistance level.

The aussie that closed Friday's trading at 87.85 against the yen

climbed to a 5-day high of 88.15. On the upside, 89.00 is likely

seen as its next resistance level.

Preliminary data from Bank of Japan showed that Japan's M2 money

supply growth eased for the second straight month in December.

The M2 money stock climbed 3.6 percent year-over-year in

December, slower than November's 4.0 percent rise.

Reversing from an early low of 1.5367 against the euro, the

aussie edged up to 1.5357. The aussie is seen finding resistance

around the 1.52 mark.

The aussie advanced to a 4-day high of 0.9902 against the

loonie, from an early 4-day low of 0.9840, and held steady

thereafter. Continuation of the aussie's uptrend may see it

challenging resistance around the 1.00 region.

Looking ahead, Eurozone trade data for November is due in the

European session.

Canada existing home sales for December are set for release at

9:00 am ET.

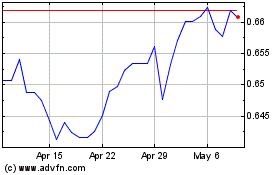

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024