By Ted Greenwald

In Qualcomm Inc.'s quest to avoid being swallowed by Broadcom

Ltd., its best bet to remain independent may be completing its own

giant acquisition. But it is running out of time.

Qualcomm has been working for more than a year to buy NXP

Semiconductors NV for $39 billion. Broadcom Chief Executive Hock

Tan has said his offer stands whether or not Qualcomm completes its

purchase, even though NXP would add 40% to Qualcomm's revenue and

give the combined companies a major presence in the fast-growing

market for chips used in cars.

Last week, Broadcom raised its bid for Qualcomm to more than

$121 billion from $105 billion in what would be technology's

biggest deal. In rejecting the revised bid Thursday, Qualcomm

accused Broadcom of ignoring the value NXP will bring, among other

criticisms. The Wall Street Journal reported Sunday that Broadcom

has secured as much as $100 billion of debt funding for its

Qualcomm bid.

The parties are scheduled to meet Wednesday, according to a

Broadcom spokesman. On Tuesday, Broadcom said it would lower the

number of independent Qualcomm directors it is nominating to six,

down from 11, a move it said would allow it to gain majority

control while ensuring some board continuity.

Even so, Mr. Tan had presented his target with a possible way

out, repeating a threat last week to withdraw if Qualcomm paid more

for NXP than it originally agreed to. While Mr. Tan appeared to

soften that stance on CNBC Monday, saying he would preserve his

options, Qualcomm could still put Broadcom on its heels by raising

its offer for NXP.

That is where things get dicey.

Qualcomm isn't likely to close the NXP acquisition until Chinese

antitrust authorities have approved the deal, its last regulatory

hurdle. On its recent earnings call, Qualcomm estimated it would

take three weeks to wrap up the acquisition once China gave the

green light, which it expected "soon." China's antitrust regulator

will take a week off for the Lunar New Year starting Feb. 15,

further squeezing the schedule.

Qualcomm, Broadcom and NXP all have said the price for NXP, $110

a share, is fair. But to close the deal, Qualcomm likely would have

to increase the price, because NXP shares have traded above the

offer price since the summer, and activist investor Elliott

Management Corp. is rallying investors to demand $135 a share.

In the best case, the closing of the NXP acquisition would

happen in time for Qualcomm's investor meeting, scheduled for March

6, giving it a notch on its belt before shareholders vote for

either Qualcomm's directors or a slate proposed by Mr. Tan.

A three-way tango between acquirers and targets isn't

unprecedented, especially in cases involving a third company lured

in as a "white knight," such as the dramatic 2014 battle between

Actavis PLC, Allergan Inc. and Valeant Pharmaceuticals

International Inc.

There is no white knight in the Broadcom-Qualcomm-NXP triangle,

but Qualcomm's completion of the NXP transaction at a higher price

would fortify it against a hostile takeover, analysts said.

"I can't recall when a very large company was trying to buy

another very large company, which was trying to buy yet another

large company," said Mike Walkley, an analyst with Canaccord

Genuity Group Inc. "Now that Qualcomm has rejected Broadcom's bid,

we believe management will likely move as fast as possible to buy

NXP once they receive regulatory approval."

Broadcom's sweetened offer failed to persuade investors. After

Broadcom announced the offer, Qualcomm shareholders pushed shares

down. The price now stands 20% below the revised offer price.

Some investors saw Mr. Tan's ultimatum as a misstep.

"You just told Qualcomm: close NXP over $110, you're off the

hook," said Steven Ré, investment chief at Fairbanks Capital

Management Inc. Qualcomm shares make up around 17% of the firm's

equity portfolios, he said.

Broadcom declined to comment on its revised bid. Qualcomm

declined to comment.

Qualcomm enters its March 6 shareholder meeting following nearly

three years of turbulence that lopped 22% from its stock price,

while the PHLX Semiconductor Index gained about 82%.

Shareholders can point to a litany of grievances, including

billions of dollars in fines from regulators over the way Qualcomm

conducts business and a price war with Apple Inc. that is keeping

billions of dollars in revenue out of its coffers as multiple cases

wind through courts. Securing NXP would give them confidence

Qualcomm can execute its plans.

"Qualcomm needs to close NXP more than ever," said Bernstein

Research analyst Stacy Rasgon, "and they'll have to offer a higher

price."

Qualcomm believes an NXP merger will supercharge its

opportunities in the markets for automotive chips, security and

equipment outfitted with computing and communications, known as the

Internet of Things -- a combined market it expects to be valued at

$77 billion by 2020, according to a recent presentation to

investors.

Broadcom has tried to cast doubt on the deal, saying in a recent

investor presentation that NXP's average revenue growth in the

first three quarters of 2017 was substantially slower than its

peers, and that it missed its own forecasts. Based on projections

in a late 2016 regulatory filing, NXP in fiscal 2017 fell short of

its goals for revenue and adjusted profit margins.

An NXP spokesman said the forecasts at issue were "management's

best-case scenarios" for presentation in advance of an

acquisition.

Write to Ted Greenwald at Ted.Greenwald@wsj.com

(END) Dow Jones Newswires

February 13, 2018 11:17 ET (16:17 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

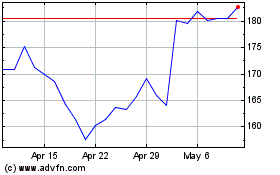

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

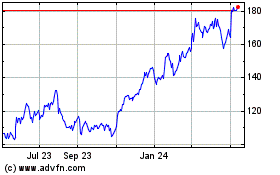

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024