Regeneron and Sanofi Plan to Cut Cholesterol Drug Price in Exchange for Wider Coverage

11 March 2018 - 10:15AM

Dow Jones News

By Joseph Walker

The makers of an expensive cholesterol-lowering drug plan to

offer discounts of up to 69% in exchange for insurers and

pharmacy-benefit managers expanding their coverage of the medicine

to more patients.

Regeneron Pharmaceuticals Inc. and Sanofi SA said they will seek

to renegotiate their contracts with insurers by offering rebates

and discounts for the drug, called Praluent, that would bring its

U.S. net price within a range of $4,500 to $8,000 annually per

patient, down from its list price of $14,600.

The net price range is based on a cost-effectiveness analysis by

an independent nonprofit group called the Institute for Clinical

and Economic Review. The group's analysis incorporated new clinical

trial data released on Saturday showing that Praluent reduced a

patient's risk of dying by 15% compared with placebo in a large

trial of patients whose cholesterol exceeded medical guidelines

despite already taking the standard treatment of statin drugs.

Regeneron and Sanofi's offer of a steep price cut reflects the

intensifying pricing pressures that some drugmakers face. Insurers

have placed significant restrictions on paying for Praluent because

of its price, such as requiring patients to have tried alternative

treatments and having doctors submit voluminous paperwork proving

their patients need the drug. The result is that the vast majority

of patients prescribed the drug don't actually fill their

prescription, says Regeneron CEO Leonard Schleifer.

ICER's analysis "represents a good faith assessment of

[Praluent's] value to patients," Dr. Schleifer said in an

interview. "Enough is enough. We're willing to work in their

[price] range, providing that payers agree to reduce their

burdensome barriers for patients."

When Praluent was first launched in 2015, it was the first of a

new type of a cholesterol-lowering drug that block a protein called

PCSK9. Analysts and investors expected drugs in the class, which

also includes Amgen Inc.'s Repatha, to quickly become blockbuster

products with $1 billion or greater in annual sales.

Instead, the drugs turned out to be a commercial disappointment

after pharmacy benefit-managers, which negotiate discounts from

drugmakers and decide which medicines to cover, clamped down on who

could receive the drugs. According to an Amgen study, just 35% of

patients prescribed a PCSK9 drug had the prescription approved by

their insurers.

Regeneron and Sanofi's Praluent had U.S. sales of $131.4 million

last year; Amgen's Repatha had U.S. sales of $225 million.

The exact discount that insurers receive will depend on how much

they relax restrictions on who gets the drug, Dr. Schleifer said.

The companies are specifically asking that insurers loosen

restrictions only for patients at the highest risk of death --

those who have had a heart attack or other serious coronary event

in the past year, and whose cholesterol levels exceed the threshold

recommended by doctors despite taking statins.

The risk of death to those high-risk patients was cut by 29% in

the clinical trial presented on Saturday at the annual scientific

meeting of the American College of Cardiology. The trial is the

first to show a statistically significant reduction in deaths by a

PCSK9 drug, compared to placebo.

Regeneron and Sanofi shared the new data with ICER in advance of

the Saturday presentation. The group found that a net price of

$4,500 to $8,000 per year would be cost-effective if the drugs were

used only by the subgroup of patients whose risk of death was

reduced by 29%. If the drugs were used more broadly to treat all

patients included in the trial, the cost-effective price would be

in a range of $2,300 to $3,400 annually, ICER said.

Regeneron and Sanofi's move to adopt ICER's recommended price

range reflects the growing scrutiny of drug costs, and calls for

pharmaceutical companies to price their products according to their

value to patients, rather than what the market will bear, ICER

President Steven D. Pearson said in an interview. "This never would

have happened three, four years ago," Mr. Pearson said.

Whether other companies also adopt ICER's recommendations will

depend on whether it moves the needle for Praluent sales, he said.

"The conversation that needs to happen is, can value-based pricing

be successful in the marketplace. They have to show this is a

successful business model."

It's unclear if the discounts will be enough for

pharmacy-benefit managers. Express Scripts Holding Co., one of the

largest PBMs, is "anxious to see the new data and re-examine our

criteria to see if they're still relevant," said Steve Miller, the

company's chief medical officer.

Write to Joseph Walker at joseph.walker@wsj.com

(END) Dow Jones Newswires

March 10, 2018 18:00 ET (23:00 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

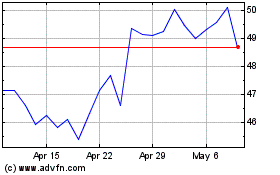

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

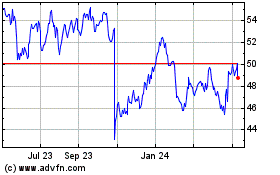

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Apr 2023 to Apr 2024