CVS Health Stockholders Approve Aetna Acquisition

14 March 2018 - 3:23AM

Dow Jones News

By Aisha Al-Muslim

CVS Health Corp. (CVS) stockholders have voted to approve the

pharmacy company's acquisition of U.S. health insurer Aetna Inc.

(AET).

More than 98% of the shares voted were in favor of the proposal,

according to the preliminary results from a special meeting

Tuesday, CVS said.

The merger is expected to close in the second half of 2018,

subject to required regulatory approvals.

In December, CVS Health announced it agreed to buy Aetna for

about $69 billion in cash and stock in a move to transform the

pharmacy company and capture more of what consumers spend on health

care.

Aetna stockholders are to receive $207 per share--$145 in cash

and 0.8378 of a CVS share, or $62, in stock, the companies said in

December.

"When this merger is complete, the combined company will be

well-positioned to reshape the consumer health care experience,

putting people at the center of health care delivery to ensure they

have access to high-quality, more affordable care where they are,

when they need it," CVS Health President and Chief Executive Larry

Merlo said in prepared remarks.

Write to Aisha Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

March 13, 2018 12:08 ET (16:08 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

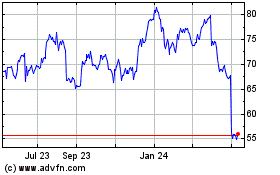

CVS Health (NYSE:CVS)

Historical Stock Chart

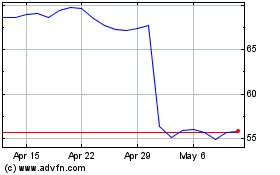

From Mar 2024 to Apr 2024

CVS Health (NYSE:CVS)

Historical Stock Chart

From Apr 2023 to Apr 2024