Russia Lowers Key Rate By 25 Bps

23 March 2018 - 7:12PM

RTTF2

Russia's central bank decided to cut its key rate by a quarter

point, amid below-target inflation, and signaled more reduction

this year.

The Board of Directors of the Bank of Russia trimmed the key

rate to 7.25 percent from 7.50 percent. The bank had lowered the

rate by 25 basis points in February.

The bank said it will continue to reduce the key rate and

complete the transition to a neutral monetary policy in 2018 as

inflation remains below 4 percent for a longer time than previously

estimated. Inflationary expectations are gradually decreasing, the

bank observed. Annual inflation is expected to be 3-4 percent at

the end of 2018 and close to 4 percent in 2019.

The gradual return of inflation to the target will contribute to

the further recovery of domestic demand, the bank said.

"The decision made at the key rate and the potential for its

subsequent reduction will further mitigate monetary conditions,

which will support the growth of domestic demand and create

conditions for annual inflation to approach 4 percent," the bank

said.

Policymakers said they will pay special attention to the

situation in the labor market, including assessing the impact of

income and wage dynamics on consumer behavior and inflation.

The GDP growth rate is forecast to be in the range of 1.5-2

percent in 2018-2020, which corresponds to the potential rates of

economic growth.

The policy rate will be lowered to 6.00 percent by the end of

this year, which is a little lower than the markets are pricing in,

William Jackson, an economist at Capital Economics, said.

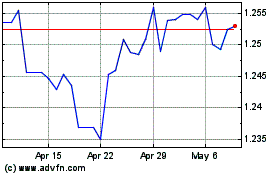

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Mar 2024 to Apr 2024

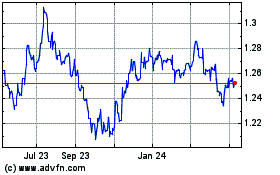

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Apr 2023 to Apr 2024