Pound Climbs After BoE McCafferty's Remarks

10 April 2018 - 3:13PM

RTTF2

The pound advanced against its major opponents in early European

deals on Tuesday, as the England policymaker Ian McCafferty

cautioned against delaying U.K. rate hike amid strong global

economic recovery and sustained wage growth.

"We shouldn't dally when it comes to tightening policy

modestly," McCafferty said in an interview with Reuters.

"It's not wages suddenly bursting away, but it gives you a

modest upside risk."

The "jury is still out" on whether the inflationary pressures

arising from a fall in the pound since the Brexit vote would wither

as quickly as expected, he told.

"On balance, those three arguments give me some potential modest

upside risks to the (inflation) forecasts."

Sentiment improved after Chinese President Xi Jinping outlined

measures to "significantly" lower import tariffs for autos and

other products and improve the investment environment for

international companies.

Speaking at the Boao Forum for Asia, Xi said that China does not

seek trade surplus and has a genuine desire to increase imports and

achieve greater balance of international payments under the current

account.

Data from the British Retail Consortium showed that U.K.

like-for-like sales surged 1.4 percent on year in March.

That topped expectations for a decline of 0.1 percent following

the 0.6 percent increase in February.

The currency has been trading higher against its major

counterparts in the Asian session, with the exception of the

greenback.

The U.K. currency firmed to 1.4168 against the greenback, its

strongest since March 28. The next possible resistance for the

pound is seen around the 1.44 level.

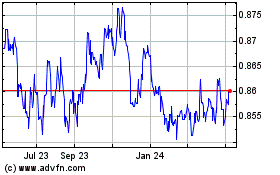

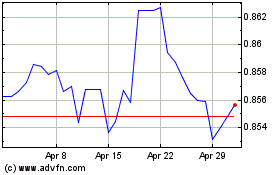

The pound rose to 1.3544 against the franc and a session's high

of 0.8698 against the euro, from its early low of 1.3504 and a

session's low of 0.8722, respectively. On the upside, 1.39 and 0.86

are seen as the next resistance levels for the pound against the

franc and the euro, respectively.

The pound advanced to a 2-month high of 151.68 against the yen,

off its early low of 150.71. The pound is seen finding resistance

around the 156.00 region.

Looking ahead, at 5:30 am ET, BOE Chief Economist Andy Haldane

speaks about the role of central banks and societal inequality at

the David Finch Public Lecture in Melbourne.

In the New York session, Canada housing starts for March and

building permits for February, as well as U.S. producer prices for

March and wholesale sales for February are due.

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Apr 2023 to Apr 2024