Commodity Rally Gives Stocks a Boost

19 April 2018 - 6:02PM

Dow Jones News

By Joanne Chiu and Riva Gold

-- European stocks flat

-- Hang Seng climbs

-- Crude oil rally continues

Stocks in Europe and Asia mostly inched higher Thursday as a

rally in commodity prices boosted shares of energy and materials

companies.

The Stoxx Europe 600 edged up 0.1% in the early minutes of

trading, following modest gains in Japan, Hong Kong and Australian

benchmarks.

Oil and mining companies led gains, with Brent crude oil last up

0.5% at $74.87 a barrel after settling Wednesday at its highest

since November 2014. Government data showed U.S. stockpiles fell by

more than analysts were expecting, the latest sign a global glut in

crude is abating.

Copper futures were last up 0.3% at $7,053 a metric ton, while

LME nickel futures were up 6.4% at $16,285 a metric ton and

aluminum futures rose 2.8% to $2,622.50 a ton. That helped Europe's

basic resources sector inch up 0.6% on Thursday.

Some investors also expect strong first-quarter results to

continue to help lift stocks after a rocky start to the second

quarter, marked by worries about trade and U.S.-led strikes in

Syria.

"With the recent jitteriness of markets ... the earnings season

should remind people that companies are still growing," said

Caroline Simmons, deputy head of the U.K. investment office at UBS

Wealth Management. "We're still quite positive on markets," she

said.

In Europe on Thursday, shares of Publicis Groupe rose 4.4% after

the advertising agency reported solid growth from its North

American business, while Swiss conglomerate ABB rose 4.3% after

reporting a drop in net profit but slightly higher revenue.

A post-earnings decline in shares of Novartis and Unilever

weighed on the broader index, however, keeping gains in check.

Earlier, Asia-Pacific stocks mostly rose Wednesday, supported by

gains in energy companies and Chinese markets.

Hong Kong's China Enterprises Index, made up of Chinese-based

firms with listings in Hong Kong, climbed 1.5%, while the benchmark

Hang Seng Index rose 1%. Oil-related stocks helped fuel gains, as

PetroChina jumped 5.3% and peer Cnooc gained 3.5%.

Australian energy stocks rose a further 0.7%, putting the

month's advance at 8.2%, on pace for the biggest monthly gain since

2011.

The Shanghai Composite Index rose 0.8% while Japan's Nikkei

Stock Average edged up 0.2%.

Signs of easing geopolitical tensions have also helped smooth

markets recently.

"The trade risk between the U.S. and China can be reduced

because ultimately China can use North Korea as a bargaining chip,"

said James Cheo, senior investment strategist at Bank of

Singapore.

But Vincent Wen, an investment manager at KCG Securities Asia,

noted that fears about trade tensions and other geopolitical risks

could re-emerge at any time. The weak March trade data from China

should also keep investors alert, he added.

Write to Joanne Chiu at joanne.chiu@wsj.com and Riva Gold at

riva.gold@wsj.com

(END) Dow Jones Newswires

April 19, 2018 03:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

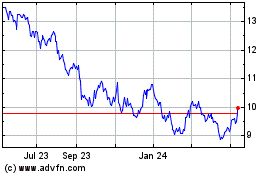

Sun Hung Kai Properties (PK) (USOTC:SUHJY)

Historical Stock Chart

From Mar 2024 to Apr 2024

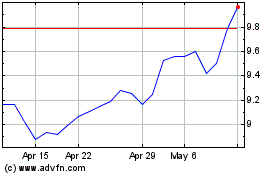

Sun Hung Kai Properties (PK) (USOTC:SUHJY)

Historical Stock Chart

From Apr 2023 to Apr 2024