Yen Falls Against Majors

24 April 2018 - 7:22PM

RTTF2

The Japanese yen declined against its major counterparts in the

European session on Tuesday amid risk appetite, as oil extended

gains amid Middle East tensions and the dollar held steady near its

highest level since January on expectations for a faster pace of

interest-rate hikes.

Oil prices soared amid expectations of renewed U.S. sanctions

against Iran and reduction in supplies by OPEC.

Iran has reportedly nixed a formal extension of the cartel's

supply quota plan with Russia, but Saudi Arabia and others will

continue to limit production beyond this year, analysts say.

Investors awaited the European Central Bank's monetary policy

decision and a potential meeting in Beijing between officials from

the world's largest and second-largest economies this week for

directional cues.

Data from the Bank of Japan showed that Japan producer prices

rose 0.5 percent on year in March. That was in line with

expectations and down from the upwardly revised 0.7 percent

increase in February.

The yen declined to a 5-day low of 152.00 against the pound from

yesterday's closing value of 151.53. The yen is seen finding

support around the 154.00 region.

The yen slipped to a 5-day low of 132.99 against the euro and a

weekly low of 111.37 against the franc, off its early highs of

132.62 and 111.08, respectively. The yen is likely to find support

around 135.00 against the euro and 113.00 against the franc.

The yen weakened to 109.07 against the greenback, its weakest

since February 9. If the yen falls further, it may find support

around the 110.5 level.

The yen weakened to 4-day lows of 84.91 against the loonie and

82.91 against the aussie, reversing from an early high of 84.58 and

a 4-day high of 82.48, respectively. On the downside, 86.00 and

84.00 are likely seen as the next support levels for the yen

against the loonie and the aussie, respectively.

The yen fell back to 77.60 against the kiwi, from near a 3-week

high of 77.34 hit at 3:00 am ET. This may be compared to a 4-day

low of 77.82 set early in the Asian session. The next possible

support for the yen is seen around the 79.00 level.

Looking ahead, U.S. new home sales for March and consumer

confidence for April are scheduled for release shortly.

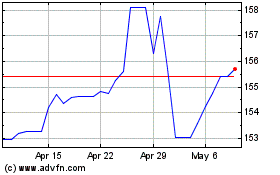

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

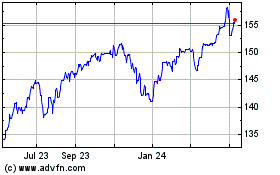

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024