McKesson Launches Comprehensive Review of Operations

26 April 2018 - 9:42AM

Dow Jones News

By Maria Armental

McKesson Corp. (MCK), which has faced scrutiny over its handling

of opioid drugs, is planning a "comprehensive review" of its

operations as part of a multiyear strategic plan to drive

growth.

As part of its revamped focus, the San Francisco-based drug

distributor has agreed to buy Medical Specialties Distributors, a

national distributor of infusion and medical-surgical supplies, in

a roughly $800 million deal that is expected to close in the first

half of fiscal 2019.

For the next fiscal year, which begins April 1, 2019, McKesson

projects adjusted profit at a $13 a share to 13.80 a share.

Analysts polled by Thomson Reuters expect adjusted earnings of

$13.36 a share.

On Wednesday, McKesson said the latest cost-cutting plan, which

includes an unspecified number of job cuts, would result in roughly

$150 million to $210 million in after-tax charges in the current

fiscal year.

McKesson maintained its fiscal 2018 guidance of $12.50 a share

to $12.80 a share, which includes about $100 million to create a

non-profit foundation to help fight the opioid epidemic in the U.S.

It expects to record between $600 million and $1.9 billion in

restructuring charges in the fourth quarter.

The company is expected to disclose more information during a

conference call Thursday morning.

Shares, which rose 2% in Wednesday trading to $151.71, rose 1.5%

after hours.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

April 25, 2018 19:27 ET (23:27 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

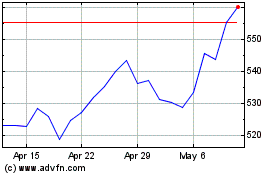

McKesson (NYSE:MCK)

Historical Stock Chart

From Mar 2024 to Apr 2024

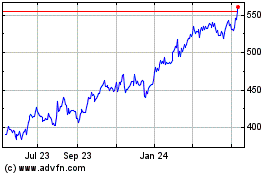

McKesson (NYSE:MCK)

Historical Stock Chart

From Apr 2023 to Apr 2024