U.S. Dollar Slides On Reducing Concerns Over Steeper Fed Rate Hikes

11 May 2018 - 5:56PM

RTTF2

The U.S. dollar drifted lower against its major counterparts in

the European session on Friday, as fears over aggressive Fed rate

hikes receded after soft U.S. inflation data for April.

Data from the Labor Department on Thursday showed that the

consumer price index rose 0.2 percent in April after edging down by

0.1 percent in March. Economists had expected consumer prices to

climb by 0.3 percent.

Core CPI edged up 0.1 percent in April after rising by 0.2

percent in the previous month. Core prices had been expected to

rise by 0.2 percent.

The data raised expectations that the Fed would continue with

its plans for two additional rate hikes this year, instead of

aggressive hikes.

Also in focus is the summit between North Korean leader Kim Jong

Un and U.S. President Donald Trump that is scheduled on June

12.

Trump said that he had plans of "doing something very

meaningful" when both leaders meet for talks aimed to denuclearize

the Korean peninsula.

The U.S. export and import prices and flash consumer sentiment

index, along with a speech by St. Louis Fed President James Bullard

are due later in the day.

The greenback held steady against its major counterparts in the

Asian session, with the exception of the yen.

The greenback fell to 1.3554 against the pound, 1.1936 against

the euro and 1.0007 against the franc, from its early highs of

1.3502, 1.1891 and 1.0040, respectively. The greenback is likely to

find support around 1.38 against the pound, 1.21 against the euro

and 0.99 against the franc.

The greenback declined to 1.2746 against the loonie and a

session's low of 0.6982 against the kiwi, off its early highs of

1.2773 and 0.6955, respectively. The next possible support for the

greenback is seen around 1.26 against the loonie and 0.71 against

the kiwi.

Extending early slide, the greenback hit a weekly low of 0.7557

against the aussie. The greenback is seen finding support around

the 0.77 level.

Figures from the Australian Bureau of Statistics showed that the

total number of owner occupied housing commitments in Australia

decreased for the fourth straight month in March.

On a seasonally adjusted basis, total number of owner occupied

dwelling commitments dropped 2.2 percent month-over-month in March,

faster than the 0.2 percent fall in February.

The greenback fell back to 109.25 against the yen, heading

closer to pierce a 2-day low of 109.20 hit at 8:45 pm ET. Next key

support for the greenback is likely seen around the 108.00

level.

Data from the Bank of Japan showed that Japan's M2 money stock

rose 3.3 percent on year in April, coming in at 1,002.5 trillion

yen.

That exceeded expectations for an increase of 3.2 percent

following the downwardly revised 3.1 percent gain in March.

Looking ahead, Canada jobs data and U.S. import and export

prices, all for April, and University of Michigan's preliminary

consumer sentiment index for May are scheduled for release in the

New York session.

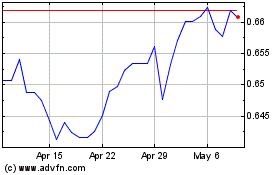

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024