Macy's Shows Signs of Life After Prolonged Slump -- Update

17 May 2018 - 2:40AM

Dow Jones News

By Suzanne Kapner and Allison Prang

After closing dozens of unprofitable stores, Macy's Inc.

reported higher sales at those locations still open amid the first

signs that the department store giant is pulling out of a prolonged

slump.

The results were buoyed by a strong economy, with low

unemployment and recent tax cuts that should give consumers more

money to spend. They bode well for other retailers scheduled to

report earnings this week, including Walmart Inc., J.C. Penney Co.

and Nordstrom Inc.

"The customer is feeling confident, and is out there ready to

spend," said Macy's Chief Executive Jeff Gennette.

Macy's said same-store sales rose 3.9% compared with the same

quarter the year before, and 4.2%, including licensed departments.

A big driver of the sales increase was a promotional event that

shifted into this year's first quarter, compared with last year,

when it occurred during the second quarter. Stripping out this

event, same-store sales on an owned plus licensed basis would have

risen 1.7%, according to Neil Saunders, managing director of

GlobalData Retail, a research firm.

But Macy's is also taking internal steps that are boosting

performance, including a streamlined merchandising structure and

new incentive plan that lets all full-and-part time staff share in

the gains based on local store and corporate performance. "We're

moving better and faster than ever before," Mr. Gennette said.

Shares in Macy's shot up nearly 9% in morning trading Wednesday

after the retailer reported same-store sales growth that widely

surpassed analysts' estimates and raised its projections for the

year.

Macy's said it now expects to earn between $3.75 and $3.95 a

share on an adjusted basis, a range 20 cents higher than its prior

guidance. The company also raised the prospects of seeing annual

sales growth. The department-store chain now expects annual sales

to be in a range of down 1% to up 0.5% from its prior forecast of

sales falling between 0.5% and 2%.

Macy's revenue rose 3.6% to $5.54 billion.

Profit climbed 78% to $139 million, or 45 cents a share. On an

adjusted basis, the company earned 48 cents a share.

Macy's had less excess inventory to clear in the period, and

customers also spent more on full-priced goods. That helped the

average ticket price rise 5%, according to the company. The

retailer also benefited from a rebound in spending by international

tourists after they pulled back in recent years due to the strong

dollar.

Mr. Gennette said Macy's was getting traction from revamped shoe

and fine jewelry departments as well as a new loyalty program that

offers tiered rewards based on spending. It is also adding new

categories to its website through its vendor direct program such as

drones and decorative home goods.

Mr. Gennette also pointed to the rollout out of Macy's

Backstage, the company's discount concept, as helping to buoy

sales. In the first quarter, Macy's opened about 20 of these

stores. It had planned to open 100 this fiscal year.

The company also said earlier this month it bought a New York

City concept store called STORY which changes up what it is selling

and its design every four to eight weeks. Macy's also said that

STORY's CEO and founder Rachel Shechtman will become a brand

experience officer at Macy's.

Mr. Gennette said another new hire, former eBay Inc. executive

Hal Lawton, was helping to give the company more operational

discipline and better marry technology with the store experience.

One initiative is the rollout of mobile checkout to all stores this

year.

Separately, Macy's said it has ended its joint venture with Fung

Retailing Ltd. in China, but would remain on Alibaba's TMall

platform.

Macy's is also in line for a new chief financial officer. In

early April, the company said CFO Karen Hoguet will retire. She

will remain CFO until a new executive is appointed to take over her

role, but she will stay as an adviser until February. Macy's has

hired a search firm to help look for a new CFO.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com and Allison

Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

May 16, 2018 12:25 ET (16:25 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

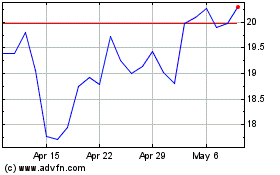

Nordstrom (NYSE:JWN)

Historical Stock Chart

From Mar 2024 to Apr 2024

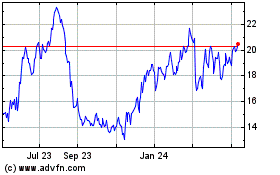

Nordstrom (NYSE:JWN)

Historical Stock Chart

From Apr 2023 to Apr 2024