By Saabira Chaudhuri and Annie Gasparro

It's mayhem in the mayonnaise aisle.

Hellmann's maker Unilever PLC and Kraft Heinz Co., which owns

Miracle Whip, are cutting prices and slinging out new concoctions

as they battle changing eating habits, a dizzying array of new

players and each other.

The two, which together account for more than 80% of U.S.

mayonnaise sales, are duking it out because they are at risk of

losing shelf space to faster-growing rivals.

U.S. sales of mayonnaise fell 6.7% between 2012 and 2017,

according to Euromonitor. Small mayonnaise brands, though, which

made up just 3.2% of the market six years ago, have almost doubled

their share and last year made up 6.1%.

Niche brands have elbowed into many supermarket categories,

marketing themselves as healthier than traditional packaged,

processed foods. Grocers are offering their own house labels. And

an explosion of specialty and flavored mayonnaises and other new

condiments is shaking up the sandwich staple, which until recently

hadn't changed much in more than a century.

"Condiments are more competitive than they've ever been," said

Jennifer Healy, head of marketing for the Heinz brand. "Ten years

ago, it was much more simple."

Miracle Whip and Kraft Mayo, Kraft Heinz's other big mayonnaise

brand, have been squeezed between cheaper offerings on one end, and

Hellmann's and other premium brands on the other. Miracle Whip --

which doesn't call itself "mayonnaise" because its oil content

doesn't match food regulators' definition -- lost almost 1

percentage point of U.S. market share between 2015 and 2017. It and

Kraft Mayo have just over 30% of the market, according to

Euromonitor.

Ms. Healy said Kraft Heinz is engaged in a major mayo push, last

month launching a new brand -- Heinz Mayo -- which uses simple

ingredients and cage-free eggs. The company also is developing a

mayonnaise-ketchup combination that it is calling "mayochup."

Hellmann's, called Best Foods west of the Rockies, has raced

ahead. While overall mayonnaise sales have declined, it boosted its

U.S. market share by 3.5 percentage points in the past three years

and now has just over 50% of the U.S. market.

Hellmann's and Kraft Mayo have come out with new flavors and

variations, like avocado-oil mayonnaise and roasted garlic and

spicy chipotle flavors. Kraft revamped the Miracle Whip recipe last

year, going back to its original ingredients and replacing high

fructose corn syrup with sugar. "It was a huge investment for us,"

said Eduardo Luz, president of Kraft Heinz's U.S. grocery

business.

But the big brands have lost some cachet. Beverley Tanel, a

Dallas-area mother of three, said she used to buy both Miracle Whip

and Hellmann's mayonnaise to use in different recipes. "They each

have their place," she said.

But she hasn't been buying as much lately. "I've gone away from

it for health reasons," Ms. Tanel said. Instead, her 16-year-old

daughter has her buying avocado-oil mayonnaise from a small brand

called Primal Kitchen, which markets its mayonnaise as sugar-free

and canola-free, among other things.

The stakes are high for Big Mayo. Condiments rank among the top

10 most profitable types of food to manufacture, according to

market research firm IBISWorld. Mayonnaise ingredients -- basically

oil, water, eggs and vinegar -- are cheap. Giant companies that

have made and marketed mayonnaise for years can "reduce cost and

improve margins," said Manny Picciola, a partner at L.E.K.

Consulting.

The extra profit is important at a time when packaged-food sales

generally are slowing. And Americans still eat a lot of mayo --

whether on sandwiches or in things like potato salad and chicken

salad. Excluding salad dressing, mayo is the country's biggest

"table sauce" by volume and sales value, according to Euromonitor,

beating even ketchup.

To keep customers and lure new ones, Unilever and Kraft Heinz

have been offering discounts. Mayonnaise prices for the first

quarter fell 0.6% versus a year ago, while overall packaged food

prices were 1.6% higher, according to Nielsen.

"Kraft went down in price and Hellmann's followed," said Wayne

Spencer, president of promotional planning company T-Pro

Solutions.

"We're engaging toe to toe," Unilever Chief Financial Officer

Graeme Pitkethly said on a recent investor call. Kraft Heinz's Ms.

Healy said, "We've been consistent on how we promote, and we

promote less than our competitors."

Both sides are also advertising heavily. A TV spot for Kraft

Heinz's new Heinz mayonnaise takes a swipe at "yesterday's brand,"

a jar with a blue top just like Hellmann's.

Unilever and Kraft Heinz's battle is spilling into other

condiments, too. Hellmann's last month launched "Hellmann's real

ketchup" in the U.S.; it is sweetened using honey instead of high

fructose corn syrup. Heinz recently started selling its own

honey-sweetened ketchup.

"We saw this as an opportunity to elevate an American staple,"

said Russel Lilly, marketing director of Hellmann's. "It's time for

ketchup to evolve."

Not everyone agrees. "It tasted like weak barbecue sauce," said

Orlando, Fla.-based food blogger James Emerson, who picked up a

bottle of honey-sweetened ketchup at his local grocery store last

month. "This just don't seem right."

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com and

Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

May 20, 2018 09:14 ET (13:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

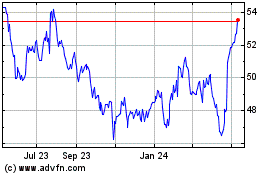

Unilever (NYSE:UL)

Historical Stock Chart

From Mar 2024 to Apr 2024

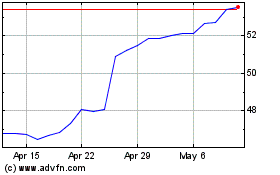

Unilever (NYSE:UL)

Historical Stock Chart

From Apr 2023 to Apr 2024