Australian Dollar Climbs On Strong Australia Retail Sales, China Services PMI

04 July 2018 - 1:02PM

RTTF2

The Australian dollar strengthened against its major

counterparts in the Asian session on Wednesday, following the

releases of upbeat Australia retail sales for May and China

services PMI data for June.

Data from the Australian Bureau of Statistics showed that

Australia retail sales rose a seasonally adjusted 0.4 percent on

month in May, coming in at A$26.673 billion.

That exceeded expectations for an increase of 0.3 percent

following the upwardly revised 0.5 percent gain in April.

The latest survey from Caixin showed that China's services

sector activity continued to expand in June, and at a faster rate,

with a PMI score of 53.9.

That beat forecasts for 52.7 and it's up from 52.9 in May, and

it moves further above the boom-or-bust line of 50 that separates

expansion from contraction.

In other economic releases, separate from the Australian Bureau

of Statistics showed that Australia logged a seasonally adjusted

merchandise trade surplus of A$827 million in May.

That was shy of expectations for a surplus of A$1.20 billion

following the downwardly revised A$472 million surplus in

April.

Asian stocks were trading mixed as trade jitters continued to

simmer ahead of the July 6 deadline for the Trump Administration's

planned imposition of tariffs on Chinese imports.

If the White House goes ahead with its plan to impose new

tariffs, the Chinese government is expected to retaliate in kind

with its own tariffs on U.S. agricultural products and other

goods.

The aussie climbed to a 9-day high of 0.7424 against the

greenback and a 5-day high of 1.5728 against the euro, from its

early lows of 0.7377 and 1.5805, respectively. The aussie is poised

to challenge resistance around 0.76 against the greenback and 1.56

against the euro. The aussie advanced to 81.97 against the yen and

1.0956 against the kiwi, reversing from its early low of 81.43 and

a 2-day low of 1.0922, respectively. On the upside, 83.00 and 1.11

are likely seen as the next resistance levels for the aussie

against the yen and the kiwi, respectively.

The aussie reversed from an early low of 0.9697 against the

loonie, rising to 0.9736. The aussie is seen finding resistance

around the 0.99 region.

Looking ahead, PMI reports from major European economies are due

in the European session.

The U.S. market is closed for Independence Day holiday.

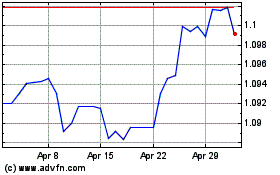

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

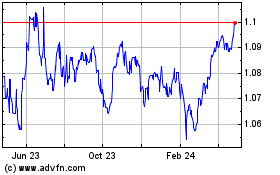

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024