BlackRock's New Investor Cash Inflows Slide

16 July 2018 - 9:48PM

Dow Jones News

By Asjylyn Loder

BlackRock Inc. pulled in $20 billion in new investor cash in the

second quarter, nearly 81% lower than the same quarter last

year.

The world's largest asset manager has vacuumed up new assets

into its massive iShares exchange-traded fund business in recent

years as investors forsake active stock pickers in favor of

low-cost index funds. But inflows slowed from last year's record

pace.

The company's iShares ETFs attracted $17.8 billion in net

inflows in the second quarter. Earnings rose 26% from the same

period a year ago, and revenue rose 11%.

"Despite an industrywide slowdown in flows associated with

investor uncertainty in the current market environment, our

dialogue with clients and opportunities to provide long-term

solutions are more robust than ever before," said Chief Executive

Larry Fink in a statement Monday morning.

In the second quarter, BlackRock made $1.07 billion, or $6.62 a

share, compared with $854 million, or $5.20 a share, for the same

period last year. On an adjusted basis, the firm earned $6.66 a

share, compared with $5.22 a share a year ago. That beat

expectations from analysts polled by FactSet of adjusted earnings

of $6.55 per share.

Revenue rose 11% to $3.6 billion compared with $3.2 billion in

the same period a year ago. As of the end of the quarter, BlackRock

had $6.3 trillion under management, up from $5.7 trillion at the

end of June 2017.

Write to Asjylyn Loder at asjylyn.loder@wsj.com

(END) Dow Jones Newswires

July 16, 2018 07:33 ET (11:33 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

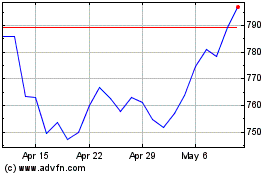

BlackRock (NYSE:BLK)

Historical Stock Chart

From Mar 2024 to Apr 2024

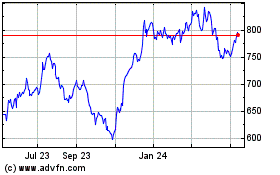

BlackRock (NYSE:BLK)

Historical Stock Chart

From Apr 2023 to Apr 2024