Facebook Sinks After Growth Warning -- WSJ

26 July 2018 - 5:02PM

Dow Jones News

By Deepa Seetharaman

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 26, 2018).

Facebook Inc. warned that its growth is slowing, sending its

stock price plummeting as investors feared the social-media titan's

fortunes aren't immune to the multiple controversies it has faced

this year.

After touching record highs earlier on Wednesday, Facebook

shares dropped as much as 23% in after-hours trading, a plunge that

would wipe roughly $130 billion from the company's value if it

holds when the markets open on Thursday. That would be more than

the entire market value of McDonald's Corp., although after-hours

declines don't always correspond to market prices the next day.

Facebook has shown few business effects from the negative

headlines that have dogged it in recent months. But winding up a

quarter during which its privacy practices stirred fresh

controversy, the company late Wednesday reported

slower-than-expected revenue growth for the period -- albeit

logging in at more than 40% -- and said it expected quarterly

revenue growth to decline over the rest of the year.

The Menlo Park, Calif., firm also showed sluggish user trends in

some of its most lucrative markets, including the U.S. and Canada,

in the second quarter.

Daily active users in the U.S. and Canada measured at 185

million, flat with the first quarter and up slightly from a year

earlier. Facebook's daily user base in Europe edged down to 279

million accounts, from 282 million in the prior quarter. Facebook

executives said that decline stemmed from a tough new European

privacy law that went into effect in the second quarter.

Some worried that the results suggest growth could be threatened

not just for Facebook but also for other tech companies that depend

on consumers spending ever-more time on their digital devices. "I

can't help but wonder if this is an early warning sign that the

market's assumptions about tech companies' growth failed to account

for the fact that each of us only has 24 hours in a day," said Jim

Anderson, CEO of SocialFlow, a platform for publishers to post

stories on Facebook and other social-media sites.

Prior to Wednesday's report, most analysts expected Facebook to

continue its streak of impressive growth that seemed impervious to

controversies about the platform's operations.

For the second quarter, Facebook reported earnings per share of

$1.74, up from $1.32 a year earlier. Revenue increased 42% to

$13.23 billion. Analysts, on average, expected earnings of $1.72 a

share on revenue of $13.36 billion, according to Thomson

Reuters.

The last time Facebook missed analyst estimates for revenue was

in the first quarter of 2015.

In a call with analysts, Facebook Chief Executive Officer Mark

Zuckerberg called the results "another solid quarter" -- but those

comments were quickly overshadowed when other executives warned

that tougher privacy laws, a shift toward less lucrative

advertising products and currency headwinds would clip revenue

growth.

They noted that the revenue growth rate fell seven percentage

points in the second quarter compared with the first three months

of the year and said the company expected quarter-to-quarter

revenue growth rates to decrease by "high single-digit percentages"

in the second half of 2018.

The company also said its expenses would rise faster than

revenue in 2019 and projected that its operating-margin percentages

would be in the mid-30s over the next several years, due to higher

spending on product and infrastructure. The second-quarter margin

was 44%.

The results "showed growth but geographically have pockets of

softness," said Daniel Ives, head of technology research at GBH

Insights.

Facebook's global reach and impact on the world have been under

scrutiny since the 2016 U.S. presidential election, when the social

network attracted criticism for allowing fabricated news articles

to flourish on the site.

Those issues intensified in March, when it suspended political

analytics firm Cambridge Analytica for improperly accessing data

from as many as 87 million Facebook users. That disclosure forced

Mr. Zuckerberg to testify in front of lawmakers on both sides of

the Atlantic in early April.

On the call Wednesday, Mr. Zuckerberg acknowledged that Facebook

needed to invest more in security measures to prevent the platform

from being manipulated. He also pledged that the company wouldn't

stop building new products "because that wouldn't be the right way

to serve our community and because we run this company for the long

term, not for the next quarter."

Despite those controversies, advertisers broadly speaking have

remained on the site, largely because there are few other outlets

that can match its reach and ability to target narrow slices of

consumers.

"It's going to take a lot more than the scandals they have had

to change to the way that advertisers are using their dollars,"

said Aaron Goldman, chief marketing officer of marketing technology

firm 4C Insights.

The support of advertisers was a key reason for continued

investor enthusiasm for the stock. Before the after-hours plunge,

Facebook's share price was up 26% since the Cambridge Analytica

revelations in March.

Write to Deepa Seetharaman at Deepa.Seetharaman@wsj.com

(END) Dow Jones Newswires

July 26, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

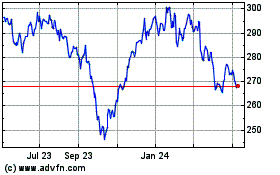

McDonalds (NYSE:MCD)

Historical Stock Chart

From Mar 2024 to Apr 2024

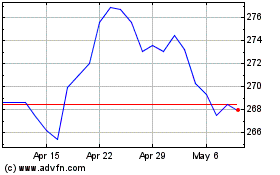

McDonalds (NYSE:MCD)

Historical Stock Chart

From Apr 2023 to Apr 2024