Australian Steelmaker Mulls $700 Million U.S. Investment -- Update

13 August 2018 - 11:45AM

Dow Jones News

By David Winning

SYDNEY--An Australian steelmaker is planning an up to US$700

million investment in the U.S., in the latest example of companies

expanding production or restarting idle mills to make up for

imports being priced out of the market in the wake of President

Donald Trump's import tariffs.

BlueScope Steel Ltd. said it is considering adding at least

600,000 to 900,000 metric tons of new steelmaking capacity at its

North Star business in the U.S., which has become a major engine of

profits at a company that for several years was focused on feeding

Asia's infrastructure boom.

Management said construction at the facility in Delta, Ohio,

would likely take up to three years and deliver a more than 40%

increase in steelmaking production capacity. North Star sells

nearly all its steel to customers in the U.S. Midwest, especially

automotive and construction companies.

"The project under evaluation involves the addition of a third

electric arc furnace and second slab caster," said Chief Executive

Mark Vassella. The project, currently in the study phase, was

outlined alongside a more than doubling in BlueScope's annual

profit to US$1.14 billion, increased dividend and expanded share

buyback program.

BlueScope's investment follows moves by other companies to

expand production, as profit margins on U.S. steel remain high.

Prices of Midwest hot-rolled coil were recently up around 40% on

year.

Many U.S. producers believe a 25% tariff imposed on steel from

many foreign countries, announced by Mr. Trump in March and

effective from the start of June, could give them the price

advantage they have lobbied for in recent years. Still, shortages

of domestic steel, coupled with rapidly rising prices, could

attract imports to the market even with tariffs.

In March, United States Steel Corp. said it would fire up a

blast furnace in Granite City, Ill., and call back 500 workers.

That marked a big swing in strategy for a company that had idled

the furnaces and laid off hundreds of workers in 2015 as a flood of

cheap imports pushed down domestic prices.

BlueScope has been widely seen as a winner from escalating

U.S.-China trade frictions because the company doubled down on the

U.S. in recent years, just as American producers were cutting

production amid a global glut. Big foreign rivals such as Germany's

Thyssenkrupp AG and Russia's OAO Severstal also cut back or

jettisoned U.S. operations.

For BlueScope, ramping up in the U.S. was part of a strategy

plotted in 2007 to diversify from its home market. Since then, the

steelmaker has continued to predict a strong outlook for American

steel demand, driven by construction and autos.

With acquisitions over the past decade or so, BlueScope has

roughly US$3 billion of steelmaking assets across 12 states. The

expansion included the 2007 purchase of IMSA Steel Corp. from

Ternium SA for US$730 million and a 2015 buyout of its 50% partner

in North Star, Cargill Inc., for US$720 million. That site is the

fifth largest producer of hot-rolled coil in North America by

volume.

BlueScope also exports more than US$200 million of metal to the

U.S. each year, mainly from its Port Kembla steelworks south of

Sydney.

Write to David Winning at david.winning@wsj.com

(END) Dow Jones Newswires

August 12, 2018 21:30 ET (01:30 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

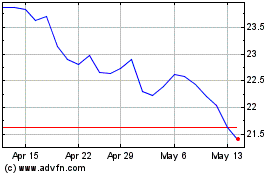

Bluescope Steel (ASX:BSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

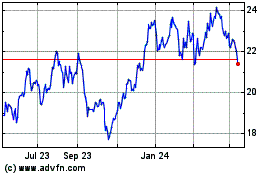

Bluescope Steel (ASX:BSL)

Historical Stock Chart

From Apr 2023 to Apr 2024