MARKET SNAPSHOT: U.S. Stocks On Track To Catch Their Breath After Prior Day's Strong Rally

17 August 2018 - 5:19PM

Dow Jones News

By Victor Reklaitis, MarketWatch

Dow industrials on pace for weekly gain of 1%

U.S. stock futures were making small moves early Friday,

suggesting the equity market could take a breather after the Dow

industrials jumped by 396 points on Thursday.

What are the main benchmarks doing?

Dow Jones Industrial Average futures rose by 29 points, or 0.1%,

to 25,621, while S&P 500 futures added 0.80 point, or less than

0.1%, to 2,845.50. Nasdaq-100 futures shed 5 points, or less than

0.1%, to 7,384.

On Thursday, the Dow , S&P and Nasdaq Composite closed

higher by

(http://www.marketwatch.com/story/us-stock-futures-point-to-gains-on-easing-geopolitical-concerns-cisco-results-2018-08-16)

1.6%, 0.8% and 0.4%, respectively.

The Dow and S&P are on pace for weekly gains of 1% and 0.3%,

respectively, as of Thursday's close, while the tech-laden Nasdaq

Composite is down 0.4% for the week, hampered by week-to-date

declines of around 1% to 3% for Microsoft Corp. (MSFT) , Facebook

Inc. (FB) and Google-parent Alphabet Inc. (AAPL)

What's driving markets?

Equity markets around the globe have sold off in recent sessions

as investors worry that Turkey's perilous financial condition could

hurt other economies

(http://www.marketwatch.com/story/why-turkeys-crisis-doesnt-spell-doom-for-all-emerging-market-currencies-2018-08-14).

But U.S. markets on Thursday got a lift from encouraging

earnings from Walmart Inc.(WMT)and Cisco Systems Inc.(CSCO) , as

well as news that the U.S. and China are prepared to resume trade

talks

(http://www.marketwatch.com/story/china-says-it-will-resume-trade-talks-with-us-2018-08-16)

next week.

What are strategists saying?

"Stock markets had a strong finish yesterday over renewed hopes

of a resolution to the trade spat between the U.S. and China," said

David Madden, an analyst at CMC Markets UK, in a note.

"It is worth remembering that this was only the confirmation of

talks restarting, and there is no guarantee that any trade deal

will be reached. Trade discussions have a history of being

protracted, and just because traders want a trade deal doesn't mean

they will get one."

Which stocks are in focus?

Chip company Nvidia Corp.(NVDA)and chip gear maker Applied

Materials Inc.(AMAT)look on pace for down days after their earnings

late yesterday. A decline in cryptocurrency-mining sales

(http://www.marketwatch.com/story/nvidia-stock-falls-as-crypto-mining-decline-overshadows-earnings-beat-2018-08-16)

appeared to weigh on Nvidia, while a weaker-than-expected guidance

(http://www.marketwatch.com/story/applied-materials-stock-falls-after-earnings-beat-weak-guidance-2018-08-16)

seemed to put pressure on Applied Materials shares. Weakness in

chipmakers could add pressure to the tech-heavy Nasdaq.

Nordstrom Inc.(JWN)is on track for an up day after the retailer

posted better-than-expected earnings and raised its outlook

(http://www.marketwatch.com/story/big-boost-in-internet-sales-help-nordstrom-beat-on-earnings-raise-outlook-2018-08-16).

Tractor maker Deere & Co.(DE)is slated to report its

quarterly earnings before the opening bell.

Which economic reports are on tap?

Releases on consumer sentiment for August and leading economic

indicators for July are due at 10 a.m. Eastern Time, and an advance

report on second-quarter services is also slated to hit at that

time.

Economists polled by MarketWatch expect a reading of 98.5 for

the sentiment index.

Check out:MarketWatch's Economic Calendar

(http://www.marketwatch.com/economy-politics/calendars/economic)

(END) Dow Jones Newswires

August 17, 2018 03:04 ET (07:04 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

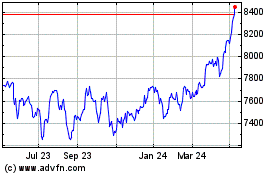

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

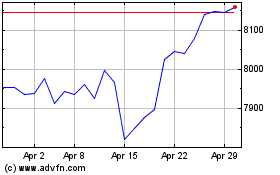

FTSE 100

Index Chart

From Apr 2023 to Apr 2024