Maersk to Continue Cost Cuts, Seeks Drilling Unit Listing

17 August 2018 - 5:20PM

Dow Jones News

By Dominic Chopping

A.P. Moeller-Maersk A/S (MAERSK-B.KO) will continue to cut costs

after lower freight rates and higher fuel costs weighed on

second-quarter earnings. The Danish freight carrier said it will

seek a separate listing of its drilling unit next year.

Maersk said last week that its earnings would be weaker than

expected this year, citing escalating trade tensions as well as

higher costs and lower rates, but in its report Friday it said cost

cuts and higher freight rates ahead will help improve

profitability.

Maersk, which moves about 18% of all containers world-wide and

is considered a barometer of global trade, said last week that it

expected its core profit this year to come in at $3.5 billion to

$4.2 billion compared with previous guidance of between $4 billion

and $5 billion.

Maersk said its profit will be hit by a 28% increase in its fuel

bill and a 1.2% decline in average freight rates.

With its previous 2018 guidance, Maersk was expecting an

underlying annual profit above the $365 million booked last year.

Without citing any numbers, it now forecasts "a positive underlying

profit."

The shipping firm Friday said second-quarter net profit was $18

million, from a $269 million loss in the same period last year. As

previously announced, revenue rose to $9.51 billion from $7.69

billion.

Maersk has been transforming itself from a sprawling shipping

and energy conglomerate into a more streamlined shipping and

logistics firm. It had set a deadline to sell its oil-drilling arm

by the end of this year, but Friday said a listing in Copenhagen

next year would offer the most optimal and long-term prospects for

its shareholders.

For Maersk Supply Service, the pursuit of a solution will

continue but the company said that due to challenging markets the

timing for defining a solution is difficult to predict.

Amid continued pressure on freight rates and a significant

increase in fuel prices and adverse changes in foreign exchange

rates, the company said it would continue to make network changes

and reduce capacity on trades not yielding the desired

profitability.

It also pledged to halt all new vessel orders until at least

2020 and to increasingly lease new dry containers as opposed to

buying them.

Write to Dominic Chopping at dominic.chopping@wsj.com; Twitter:

@domchopping @WSJNordics

(END) Dow Jones Newswires

August 17, 2018 03:05 ET (07:05 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

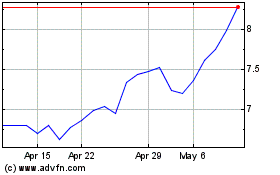

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

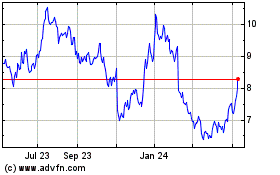

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Apr 2023 to Apr 2024