U.S. Dollar Slides Amid Trade Worries

17 September 2018 - 6:46PM

RTTF2

The U.S. dollar fell against its major counterparts in the

European session on Monday, as investors awaited new U.S tariffs on

Chinese goods that would escalate a trade war.

The Trump administration is set to impose another US$200 billion

in tariffs on goods imported from China this week as hopes fade for

a thaw in trade relations between the world's two largest

economies.

The Wall Street Journal reported that the White House was set to

impose the tariffs at 10 percent, instead of the earlier figure of

25 percent.

Reports said that China is mulling to abandon from trade talks,

in case of new tariffs.

The currency held steady against its major counterparts in the

Asian session, with the exception of the pound.

The greenback dropped to 0.9635 against the franc, after rising

to a 4-day high of 0.9680 at 5:30 pm ET. The greenback is seen

finding support around the 0.95 level.

The greenback edged down to 1.1670 against the euro, reversing

from a high of 1.1618 seen at 3:00 am ET. Next key support for the

greenback is seen around the 1.19 region.

Final data from Eurostat showed that Eurozone inflation slowed

as estimated in August.

Harmonized inflation came in at 2 percent in August versus 2.1

percent in July, which was the highest since December 2012. The

rate came in line with the estimate published on August 31.

Pulling away from a high of 1.3067 hit at 5:00 pm ET, the

greenback reversed direction and declined to 1.3134 against the

pound. On the downside, 1.35 is possibly seen as the next support

level for the greenback.

The International Monetary Fund warned that the UK economy will

suffer substantial costs if the country leaves the European Union

without a deal.

Though the UK and the EU have reached agreement in principle on

a 21-month implementation period, the "fundamental questions—such

as the future economic relationship between the two and the

closely-related question of the status of the land border with

Ireland—remain unanswered," the lender said.

The greenback declined to 1.3014 against the loonie, 0.7183

against the aussie and 0.6578 against the kiwi, coming off from an

early high of 1.3049, 5-day highs of 0.7142 and 0.6539,

respectively. If the greenback falls further, it may find support

around 1.29 against the loonie, 0.74 against the aussie and 0.68

against the kiwi.

Meanwhile, the greenback bounced off to 112.11 against the yen,

from a low of 111.85 hit at 3:45 am ET. The next possible

resistance for the greenback is seen around the 114.00 level.

Looking ahead, Canada existing home sales for August and New

York Fed's empire manufacturing data for September are due in the

New York session.

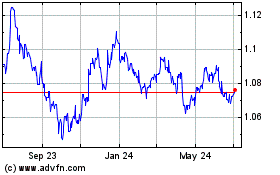

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Mar 2024 to Apr 2024

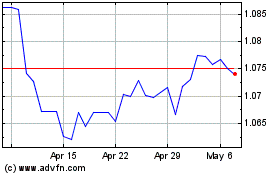

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Apr 2023 to Apr 2024