Higher Prices for Burgers Help McDonald's Sales

24 October 2018 - 2:27AM

Dow Jones News

By Julie Jargon

McDonald's Corp. is still struggling to attract more U.S.

customers but it eked out higher sales this quarter by charging

more for its food.

The company has been trying to revive traffic growth in the U.S.

by upgrading restaurants, serving burgers made with fresh rather

than frozen beef and offering drinks for a dollar. The chain also

has been trying to make its food healthier by removing

preservatives from its burgers.

However, the 2.4% growth in same-store sales in its home market,

which was roughly in line with analysts' expectations, was largely

driven by higher-priced menu items.

Globally, the restaurant did better, beating expectations for

same-store sales growth, with a 4.2% increase, resulting in its

13th consecutive quarter of positive same-store sales growth

globally.

"The strength in markets outside the U.S. is encouraging when

considering broader concerns about slower economic growth," said

Baird analyst David Tarantino.

Shares in McDonald's rose by nearly 6% in morning trading.

The chain's U.S. franchisees, who own roughly 95% of the

country's more than 14,000 restaurants, say the only way to grow is

to attract more customers into the restaurants.

But rival fast-food chains have been offering low-priced meals

at breakfast, which in previous quarters have stolen share from

McDonald's in the critical morning hours, which account for about

25% of the chain's U.S. sales. McDonald's is not only competing for

diners with other restaurants but also with food purchased for

at-home consumption.

A group of some 400 franchisees met recently to discuss forming

an independent association to address concerns about profitability.

The franchisees say they're worried about not seeing a return on

their investment from efforts to remodel restaurants, which the

company is accelerating.

McDonald's franchisees have been remodeling restaurants

throughout the U.S. to be more modern. Some stores have been

completely rebuilt while others have been upgraded with features

such as touch-screen order kiosks, mobile order pickup areas and

digital menu boards at the drive-through.

McDonald's said it expects to add 600 new restaurants this year

and to have about $2.5 billion in capital expenditures for the

year. Of that amount, $1.6 billion will be for the U.S., up from

the $1.5 billion it had forecast in July. The company also said it

expects to complete about 4,000 additional remodeling projects in

the U.S. this year resulting in half of the total U.S. restaurants

being upgraded by the end of the year.

Closures or disruptions due to construction have resulted in

lost sales for many restaurants, according to franchisees. A report

from research firm Gordon Haskett found that once restaurants

completed the upgrades, customer traffic increased

considerably.

McDonald's revenue fell 6.7% from the year-ago quarter to $5.37

billion due to the sale of more company-owned restaurants to

franchisees. The figure beat analysts' estimates. The company has

spent the past few years moving its business model toward one that

is owned mostly by franchisees, which it said gives it a more

stable and predictable revenue stream.

The company's third-quarter profit fell 13% to $1.64 billion. It

said earnings were $2.10 a share, down from $2.32 a share a year

ago. Excluding the impact of a prior year gain and restructuring

and impairment charges, earnings per share increased 19%. Earnings

beat analyst expectations.

--Allison Prang contributed to this article.

Write to Julie Jargon at julie.jargon@wsj.com

(END) Dow Jones Newswires

October 23, 2018 11:12 ET (15:12 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

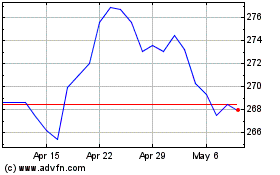

McDonalds (NYSE:MCD)

Historical Stock Chart

From Mar 2024 to Apr 2024

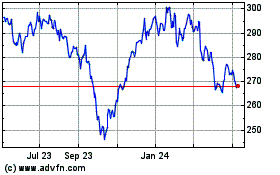

McDonalds (NYSE:MCD)

Historical Stock Chart

From Apr 2023 to Apr 2024