Australian Dollar Extends Rally After RBA Raises Economic Growth Forecast

06 November 2018 - 5:58PM

RTTF2

The Australian dollar continued to be higher against its major

counterparts in the European session on Tuesday, after the Reserve

Bank of Australia kept its interest rate on hold and slightly upped

its growth forecast for this year and next.

The board of the Reserve Bank of Australia, governed by Philip

Lowe, voted to maintain the cash rate at 1.50 percent. The interest

rate has been at the current level since August 2016.

"Taking account of the available information, the Board judged

that holding the stance of monetary policy unchanged at this

meeting would be consistent with sustainable growth in the economy

and achieving the inflation target over time," the bank said in a

statement.

The bank raised its forecast for economic growth in 2018 and

2019, which is expected to average around 3.5 percent. Earlier, the

bank expected GDP growth to average 3.25 percent for both this year

and next.

Meanwhile, caution prevailed ahead of key economic and political

events scheduled for the week, which includes the midterm elections

in the U.S., and the Federal Reserve's monetary policy review.

In the US midterm elections, it is expected that the democrats

will regain control of the House while Republicans hold on to a

slender majority in the Senate. Reuters is of the view that global

stocks may rally on hope of more tax cuts if Republicans retain

their House majority.

The currency has been trading in a positive territory against

its major counterparts in the Asian session.

The aussie strengthened to a 4-day high of 0.7240 against the

greenback, from a low of 0.7205 hit at 10:15 pm ET. The aussie is

poised to find resistance around the 0.74 level.

The aussie firmed to 81.97 against the yen, its highest since

October 2. The aussie is seen finding resistance around the 83.00

region.

Data from the Ministry of Internal Affairs and Communications

showed that Japan household spending fell 1.6 percent on year in

September, coming in at 271,273 yen.

That was well shy of expectations for an increase of 1.5 percent

and down sharply from the 2.8 percent gain in August. After falling

to 1.5832 against the euro at 10:15 pm ET, the aussie reversed its

course and touched a 4-day high of 1.5755. On the upside, 1.55 is

possibly seen as the next resistance level for the aussie.

Survey data from IHS Markit showed that Eurozone's private

sector expanded at the weakest pace in over two years in October as

both manufacturing and services recorded slower rates of

growth.

The composite Purchasing Managers' Index, or PMI, fell to 53.1

from September's 54.1. The reading was the lowest since September

2016. The flash reading for the composite PMI was 52.7.

The aussie appreciated to 0.9497 against the loonie, a level not

seen since September 6. Next key resistance for the aussie is

likely seen around the 0.96 area.

The aussie held steady against the kiwi, after having advanced

to a 4-day high of 1.0851 at 11:30 pm ET. The pair was valued at

1.0813 when it closed deals on Monday.

Looking ahead, at 8:30 am ET, Canada building permits for

September will be out.

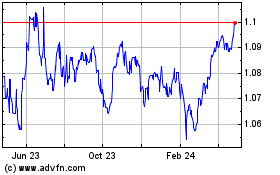

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

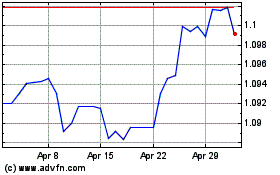

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024