UK Regulator Says Experian's ClearScore Acquisition Threatens Competition

28 November 2018 - 6:47PM

Dow Jones News

By Adam Clark

The U.K.'s Competition and Markets Authority said Wednesday that

it has found Experian PLC's (EXPN.LN) takeover of credit-data rival

ClearScore could reduce competition.

The CMA said its phase 2 investigation provisionally found the

combination of the two largest credit-checking firms in the U.K.

would substantially reduce the pressure to develop innovative

offers and make service improvements.

The CMA is now asking for views on the provisional findings by

Dec. 19 before making a final decision on the acquisition before

the deadline for its final report in March.

Experian said it was disappointed by the findings and argued the

acquisition would have a positive impact on competition. The FTSE

100 company said it will continue to engage with the CMA and seek

to address its concerns.

Experian in March announced the acquisition worth 275 million

pounds ($351 million) and said it expected to close the deal in

2018.

Write to Adam Clark at adam.clark@dowjones.com;

@AdamDowJones

(END) Dow Jones Newswires

November 28, 2018 02:32 ET (07:32 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

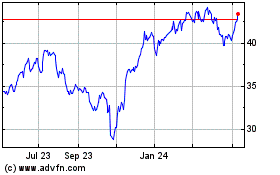

Experian (QX) (USOTC:EXPGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

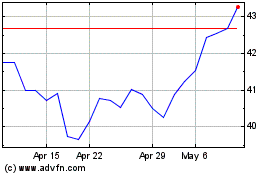

Experian (QX) (USOTC:EXPGY)

Historical Stock Chart

From Apr 2023 to Apr 2024