Rio Tinto to Build New US$2.6 Billion Iron-ore Mine -- Update

29 November 2018 - 10:01AM

Dow Jones News

By Rhiannon Hoyle

SYDNEY--Rio Tinto PLC (RIO.LN) approved a US$2.6 billion

iron-ore mine in the Australian Outback that will be the miner's

most high-tech operation to date and buoy future production as

older pits are depleted.

Rio Tinto, the world's second biggest mining company by value

and No. 2 shipper of iron ore, the key ingredient in steel, said it

will start construction of the Koodaideri iron-ore mine in Western

Australia state next year with the goal of producing ore there by

late 2021.

"Koodaideri is a game-changer for Rio Tinto," said Chief

Executive Jean-Sebastien Jacques. "It will be the most

technologically advanced mine we have ever built and sets a new

benchmark for the industry in terms of the adoption of automation

and the use of data to enhance safety and productivity."

Mining companies have been stepping up their use of technologies

such as automated drills and trucks, drones and sensors as they

strive to make their mines less costly and more efficient.

Rio Tinto, widely viewed as a mining-industry leader on

technology, says the Koodaideri mine will include more than 70

innovations that have been used ad hoc across its existing pits

including a digital replica of the processing plant, an automated

workshop and data analytics aimed at getting the best output and

cutting downtime.

At full capacity, the mine will produce 43 million metric tons

of iron ore a year. That will help sustain Rio Tinto's existing

production of Pilbara Blend, its flagship product, the company

said.

Last year, Rio Tinto produced 330 million tons from Australia's

remote Pilbara region, where it runs a network of more than a dozen

mines, 1,000 miles of rail and several port terminals. The company

has been working to shore up its future supply of iron ore to help

replace older mines, predicting the world will continue to demand

plenty of steel as big buyers such as China continue to expand,

even at lesser rates.

Rio Tinto has long relied on iron ore for much of its profits,

running some of the cheapest mines in the world with earnings

margins higher than 60%.

The US$2.6-billion budget includes US$146 million approved in

August for early works at the site. In addition to the mine, the

company will build an airport and worker camp.

The cost will be higher than the US$2.2 billion estimated in

2016, which Rio Tinto said is linked to a capacity increase to 43

million tons from an earlier proposal of 40 million. It has also

factored in cost inflation for labor and materials.

Rio Tinto also approved a US$44 million study into a possible

later expansion of the operation, which could increase production

to 70 million tons or beyond.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

November 28, 2018 17:46 ET (22:46 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

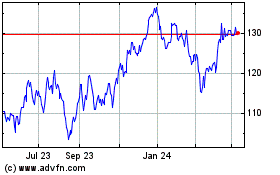

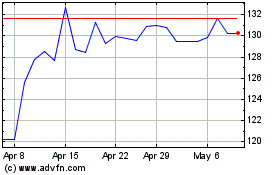

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024