Australian Dollar Falls After Weak GDP Data

05 December 2018 - 1:02PM

RTTF2

The Australian dollar slipped against its major counterparts in

the Asian session on Wednesday, after a data showed that nation's

economy grew less than expected in the third quarter.

Data from the Australian Bureau of Statistics showed that

Australia's GDP rose a seasonally adjusted 0.3 percent on quarter

in the third quarter.

That missed expectations for an increase of 0.6 percent and was

down from 0.9 percent in the second quarter.

On a yearly basis, GDP expanded 2.8 percent - again missing

forecasts for 3.3 percent and down from 3.4 percent in the three

months prior.

The currency was weighed by risk aversion as a yield curve

inversion, or short-term debt yields trading above longer-term debt

yields, stoked fears about an upcoming economic slowdown. Mounting

skepticism about the trade war truce reached between U.S. President

Donald Trump and Chinese President Xi Jinping also weighed on the

markets.

The aussie dropped to a weekly low of 0.7282 against the

greenback, from a high of 0.7356 seen at 7:05 pm ET. On the

downside, 0.71 is seen as the next likely support level for the

aussie.

Having climbed to 82.99 against the yen at 7:25 pm ET, the

aussie reversed direction and slipped to a weekly low of 82.28. The

aussie is poised to find support around the 81.00 mark.

The latest survey from Nikkei showed that Japan services sector

continued to expand in November, albeit at a fractionally slower

pace, with a PMI score of 52.3.

That's down from 52.4 in October, although it remains well above

the boom-or-bust line of 50 that separates expansion from

contraction.

The aussie weakened to a 5-day low of 1.5548 against the euro,

after rising to 1.5422 at 7:05 pm ET. The aussie is seen finding

support around the 1.58 mark.

The aussie hit a weekly low of 0.9678 against the loonie, off

its early 2-day high of 0.9749. The next possible support for the

aussie is seen around the 0.95 level.

The aussie declined to an 8-month low of 1.0525 against the kiwi

and held steady thereafter. At yesterday's close, the pair was

worth 1.0589.

Looking ahead, PMIs from major European economies and Eurozone

retail sales for October are due in the European session.

At 8:15 am ET, ADP private payrolls data for November is

scheduled for release.

The Bank of Canada announces its interest rate decision at 10:00

am ET. Economists forecast the benchmark rate to remain unchanged

at 1.75 percent.

Simultaneously, U.S. ISM non-manufacturing composite index for

November is set for release.

The Federal Reserve's Biege book report is due at 2:00 pm

ET.

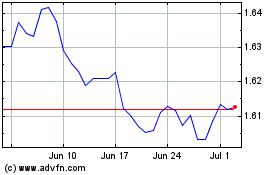

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024