RBS Will Move Assets to Netherlands in Early March if Brexit Talks Fail

07 December 2018 - 2:23AM

Dow Jones News

By Adam Clark

Royal Bank of Scotland Group PLC (RBS.LN) said Thursday that it

is preparing to transfer 13 billion pounds ($16.5 billion) of

assets and liabilities to a Dutch subsidiary by early March in case

of a disorderly Brexit.

The British lender said it expects around 30% of the customers

of its investment banking arm, NatWest Markets, to be transferred

to the Dutch unit and will move existing transactions by March 4 if

faced with a "immediate loss of access to the European single

market."

RBS said it has designed the transfer in a flexible manner so it

can respond to any political changes in relation to U.K.'s expected

exit from the European Union on March 29. The move underlines the

uncertainty facing British businesses in planning for Brexit, as

the U.K. leaving the bloc with no trade deal, or entering a

transition period, or even continuing as part of the EU all remain

potential options.

"During a transition period, the move of non-UK EEA [European

Economic Area] customers to NatWest Markets N.V. may be more

gradual and subject to further political developments," RBS

said.

As a domestic-focused lender, RBS faces less potential

disruption from Brexit than many of its peers. Last week, lobby

group Frankfurt Main Finance estimated London will lose up to 800

billion euros ($907 billion) in assets by March, with 30 banks and

financial firms choosing to set up their new EU headquarters in the

German city.

Write to Adam Clark at adam.clark@dowjones.com;

@AdamDowJones

(END) Dow Jones Newswires

December 06, 2018 10:08 ET (15:08 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

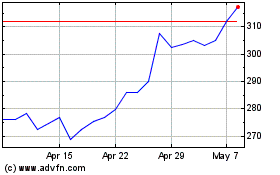

Natwest (LSE:NWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Natwest (LSE:NWG)

Historical Stock Chart

From Apr 2023 to Apr 2024