Disney, Comcast to Account for Nearly 40% of Spending on U.S. Programming

08 December 2018 - 10:05AM

Dow Jones News

By Erich Schwartzel

LOS ANGELES -- The sale of major assets of 21st Century Fox Inc.

will create two juggernauts of programming, Walt Disney Co. and

Comcast Corp., that will tower over a rapidly consolidating media

and entertainment landscape, according to a report by Ampere

Analysis.

Disney's $71 billion deal to acquire Fox's film and television

divisions and Comcast's agreement to buy the pay-TV operator Sky

PLC will create companies that together control nearly 40% of all

programming spending in the U.S., the analysis found. Globally, the

two will account for 20% of such spending.

"That would be the most concentration we've seen," said Daniel

Gadher, an analyst at the London-based media analysis firm.

The findings underscore how traditional Hollywood studios are

responding to the threat posed by Netflix Inc., which has pledged

to spend $8 billion on programming and helped drive Disney to buy

Fox in the first place. As theatrical attendance stagnates and

cord-cutting consumers cancel cable subscriptions, studios have

been rushing to find ways to pipe their movies and television shows

directly into the home and establish their own commercial

relationships with their customers.

"Netflix was on course to catch -- and overtake -- the top

Hollywood studios by content spend," the report stated. "However,

in light of the two new combined entities, Netflix would now need

to triple spend to achieve this feat."

Now traditional Hollywood is attempting to turn the tables by

siphoning business from Netflix. Ampere projects Disney and

Comcast, through its NBCUniversal and Sky divisions, will spend a

combined $43 billion on programming by the end of 2018 -- $22

billion of it coming from Disney-Fox and the other $21 billion from

NBCUniversal-Sky.

The Disney-Fox share of domestic programming spending will be

23% after the merger, the analysis found.

21st Century Fox and Wall Street Journal -parent News Corp share

common ownership.

The Ampere report, which examined company filings and executive

statements, measured spending on original and licensed programming

produced for viewing in the home, whether through traditional cable

packages or streaming services. Spending on theatrical movie

releases wasn't included.

Disney is planning to start its own direct-to-consumer service

in late 2019, using Fox programming to build out its library. The

service will include movies from Disney mainstays such as Pixar

Animation and Marvel Studios alongside Fox's National

Geographic.

In just over a year, Disney has reoriented itself in an effort

to catch the streaming wave. A separate sports service, ESPN Plus,

started in April, and the Fox deal will also give the company

majority control of the Hulu streaming service when it closes early

next year.

Comcast itself attempted to acquire the Fox film and TV assets

last year, driving up Disney's bid and ultimately walking away with

control of Sky for $38.8 billion. That gives the cable operator a

strong foothold in Europe, where Sky sells phone, TV and internet

services to 23 million customers.

Netflix isn't the only competition they face. AT&T Inc.,

which purchased Time Warner Inc. this year, is planning a streaming

service that will bundle programming from HBO and other properties.

It is also set to launch late next year.

Write to Erich Schwartzel at erich.schwartzel@wsj.com

(END) Dow Jones Newswires

December 07, 2018 17:50 ET (22:50 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

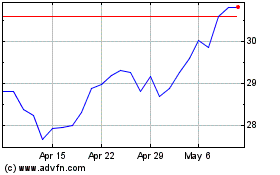

Fox (NASDAQ:FOX)

Historical Stock Chart

From Mar 2024 to Apr 2024

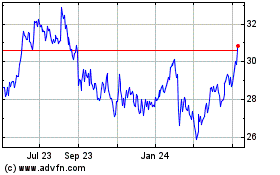

Fox (NASDAQ:FOX)

Historical Stock Chart

From Apr 2023 to Apr 2024