By Mark DeCambre and Chris Matthews, MarketWatch

All three major benchmarks will start the day in correction

Stock benchmarks looked set to slump Monday after the Dow Jones

Industrial Average fell into correction territory last week, and

the three main benchmarks marked their worst start to December

trading since 1980, amid fears of global growth and an aggressive

Federal Reserve.

How did benchmarks trade?

Futures for the Dow were off 139 points, or 0.6%, at 23,974,

those for the S&P 500 were off 12.25 points, or 0.5%, at 2,590,

and Nasdaq-100 futures retreated 30.25 points to 6,569, a drop of

0.5%.

On Friday, the Dow fell 496.87 points, or 2%, to end at

24,100.51, for its lowest close since May 3. The S&P 500 shed

50.59 points, or 1.9%, to close at 2,599.95, its lowest finish

since April 2. The Nasdaq Composite Index dropped 58.59 points, or

0.8%, to finish at 6,910.66, marking its lowest close since Nov.

20.

The drop has left the Dow more than 10% below its Oct. 3 record

high, meeting the widely used definition of a correction. The

blue-chip gauge joined the S&P 500 and the Nasdaq in correction

phase.

Read: Here's why the Fed won't save the stock market, despite

its worst December start since 1980

(http://www.marketwatch.com/story/heres-why-the-fed-wont-save-the-stock-market-despite-its-worst-december-start-since-1980-2018-12-15)

What's driving the market?

Wall Street stocks are on track to slip to start the week as the

Fed will conclude its final policy meeting of 2018 on Wednesday.

Although the market is widely expecting a rate increase of a

quarter of a percentage point, investors will parse the bank's

statements and projections to understand policy makers' plans in

2019.

The central bank last issued projections for the future path of

interest rates in September, when it showed that the median member

of the Fed's interest-rate setting committee predicted the bank

would raise interest rates once more in December and three times in

2019.

Since that time, evidence of slowing global growth, a rising

dollar, and slower inflation has helped encourage Fed officials to

become more dovish in their public statements, while fed funds

futures markets show investors predict only one

(https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html)

or fewer rate increases next year.

Anxieties over rate-setting come amid mounting signs of slowing

global growth, which investors worry could help to derail the bull

market.

On Friday, evidence of the effects of rising U.S.-China trade

tensions, and of a broader slowing of the Chinese economy, cropped

up as China released data

(http://www.marketwatch.com/story/china-economic-activity-mostly-slowed-in-november-2018-12-14)

that showed both industrial output and retail sales for November

missed economists' forecasts.

What are analysts saying?

"U.S. futures are showing zero rebound from Friday's weakness,

with tepid action ahead of a bevy of catalysts this week," wrote

Dave Lutz, head of ETFs at JonesTrading, in a note to clients,

arguing that traders are hesitant to make any big bets ahead of

events like a speech on economic policy from Chinese president Xi

Jinping due Tuesday, as well as the Fed decision.

"In summary; we look for a mixed sessions as investors weariness

continues to impact market sentiment.," wrote Peter Cardillo, chief

market economist at Spartan Capital Securities.

What data are ahead?

A reading of regional industrial production, the Empire State

index for December, showed manufacturing activity growing at a

sharply slower pace compared with November

(http://www.marketwatch.com/story/empire-state-factory-index-slumps-in-december-2018-12-17).

The index fell 12.4 points to 10.9 in December, below consensus

expectations of 21, according to a survey by Econoday.

A reading of home builders index for the same month is scheduled

for 10 a.m.

What stocks are in focus?

Shares of Best Buy Co Inc. (BBY) are in focus after Bank of

America downgraded the stock to underperform. The stock is down

5.5% in premarket action.

Johnson & Johnson(JNJ) shares remain under pressure before

the bell Monday, with the stock slipping 0.6%, after a more than

10% decline Friday following allegations

(http://www.marketwatch.com/story/johnson-johnson-stock-slammed-by-report-it-knew-of-asbestos-in-baby-powder-2018-12-14)

that it knew that its popular baby powder product was contaminated

with asbestos.

Jack in the Box Inc. (JACK) stock is surging 4.8% in premarket

trade, after the firm disclosed that it is exploring a possible

sale.

Goldman Sachs Group Inc. (GS) shares are down 1.9% in premarket

trade, after the Malaysian government filed criminal charges

against the bank and one of its former partners, in connection with

the 1MDB financial scandal.

How are other markets trading?

Asian stocks closed mixed Monday

(http://www.marketwatch.com/story/asian-shares-inch-higher-ahead-of-meetings-by-fed-chinas-economic-policymakers-2018-12-16),

with the Nikkei rising 0.6%, Hong Kong's Hang Seng virtually

unchanged, and the Shanghai Composite Index edging 0.1% higher.

In Europe, stocks are broadly lower, with the Stoxx Europe and

FTSE 100 retreating on Monday.

Crude oil

(http://www.marketwatch.com/story/oil-bounces-back-from-weekly-decline-2018-12-17)is

rising 0.4%

(http://www.marketwatch.com/story/oil-bounces-back-from-weekly-decline-2018-12-17),

while gold is advancing nearly 0.2% and the U.S. dollar retreating

0.3%.

(END) Dow Jones Newswires

December 17, 2018 09:16 ET (14:16 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

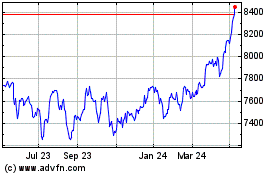

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

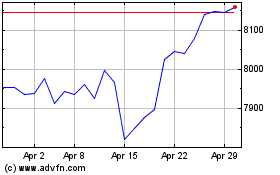

FTSE 100

Index Chart

From Apr 2023 to Apr 2024