Dollar Trading Mixed After G20 Agreement

04 December 2018 - 1:15AM

RTTF2

The dollar is turning in a mixed performance against its major

rivals Monday afternoon. President Trump and Chinese President Xi

Jinping agreed to a 90-day truce in the escalating trade war

between the two countries over the weekend. The news sparked a

rally in global equities, but has had less of an impact on the

currency market.

A White House statement said Trump agreed not to raise the

tariffs on $200 billion worth of Chinese goods to 25 percent from

10 percent on January 1st as planned.

In return, China agreed to purchase a "not yet agreed upon, but

very substantial, amount" of agricultural, energy, industrial, and

other product from the U.S.

The White House said the U.S. and China will use the next 90

days to attempt to reach an agreement on issues such as forced

technology transfer, intellectual property protection, and

non-tariff barriers.

Manufacturing activity in the U.S. unexpectedly grew at a faster

rate in the month of November, according to a report released by

the Institute for Supply Management on Monday.

The ISM said its purchasing managers index climbed to 59.3 in

November after falling to 57.7 in October, with a reading above 50

indicating growth in manufacturing activity. Economists had

expected the index to edge down to 57.5.

With a drop in spending on private construction more than

offsetting an increase in spending on public construction, the

Commerce Department released a report on Monday showing an

unexpected dip in U.S. construction spending in the month of

October.

The Commerce Department said construction spending edged down by

0.1 percent to an annual rate of $1.309 trillion in October after

slipping by 0.1 percent to a downwardly revised rate of $1.311

trillion in September.

The modest decrease came as surprise to economists, who had

expected construction spending to rise by 0.3 percent compared to

the nearly unchanged reading originally reported for the previous

month.

The dollar dropped to a low of $1.1379 against the Euro Monday,

but has since bounced back to around $1.1345.

Eurozone's manufacturing growth slowed less-than-expected in

November, amid marginal growth in output and weak business

confidence, and was the lowest since August 2016, final data from

IHS Markit showed on Monday.

The manufacturing purchasing managers' index fell to 51.8 from

52 in October. The flash reading was 51.5.

The buck climbed to a high of $1.2698 against the pound sterling

Monday, but has since eased back to around $1.2725.

UK manufacturing growth improved in November, but activity

remained subdued amid a second consecutive month of decline in

export orders, though domestic demand increased as Brexit worries

prompted clients to stock up on supplies.

The CIPS manufacturing purchasing managers index rose to 53.1

from October's 27-month low of 51.1, survey data from IHS Markit

showed on Monday. Economists had forecast a score of 51.7.

The greenback has risen to around Y113.650 against the Japanese

Yen Monday afternoon, from an early low of Y113.374.

The manufacturing sector in Japan continued to expand in

November, albeit at a slower pace, the latest survey from Nikkei

revealed with a manufacturing PMI score of 52.2. That's down from

52.9 in October, although it remains above the boom-or-bust line of

50 that separates expansion from contraction.

Capital spending in Japan was up 4.5 percent on quarter in the

third quarter of 2018, the Ministry of Finance said on Monday - shy

of expectations for an increase of 8.5 percent and down from 12.8

percent in the three months prior. Excluding software, capex added

just 2.5 percent - well shy of forecasts for 10.7 percent and down

from 14.0 percent in Q2.

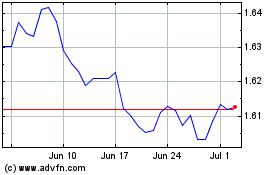

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024