Dollar Little Changed Ahead Of Fed Decision

19 December 2018 - 12:28AM

RTTF2

The dollar got off to a weak start Tuesday, but has since pared

its losses against its major rivals. The currency is now little

changed overall on the day, as investors turn cautious ahead of

tomorrow's policy decision from the Federal Reserve.

The Fed is widely expected to raise interest rates by a quarter

point Wednesday afternoon. Traders are likely to closely scrutinize

the central bank's accompanying statement and forecasts for clues

about future rate hikes.

With a spike in new construction of multi-family homes more than

offsetting a continued decrease in new construction of

single-family homes, the Commerce Department released a report on

Tuesday showing a substantial increase in U.S. housing starts in

the month of November.

The Commerce Department said housing starts jumped by 3.2

percent to an annual rate of 1.256 million in November from the

revised October estimate of 1.217 million. Economists had expected

housing starts to edge down to a rate of 1.225 million from the

1.228 million originally reported for the previous month.

The report also said building permits surged up by 5.0 percent

to an annual rate of 1.328 million in November from the revised

October rate of 1.265 million. Building permits, an indicator of

future housing demand, had been expected to dip to a rate of 1.259

million from the 1.263 million originally reported for October.

The dollar dropped to a low of $1.1402 against the Euro Tuesday,

but has since rebounded to around $1.1350.

Germany's business confidence eased for a fourth straight month

in December to its lowest level in two years, as businesses were

increasingly worried about the political developments in Europe and

a slowing global growth, suggesting that the biggest economy in the

euro area may slide into a technical recession.

The Ifo Business Climate Index dropped to 101 from 102 in

November, the Munich-based Ifo Institute said Tuesday. Economists

had expected a score of 101.7.

The buck fell to a low of $1.2705 against the pound sterling

Tuesday, but has since bounced back to around $1.2625.

The greenback dropped to a 1-week low of Y112.248 against the

Japanese Yen Tuesday, but has since rebounded to around

Y112.575.

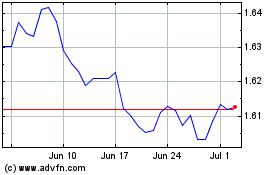

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024