By Yuka Hayashi

The credit-reporting industry has largely escaped new oversight

from Washington following the 2017 hack of Equifax Inc. that

exposed the personal information of millions of Americans. That

could change in 2019 when Democrats take over the House of

Representatives.

House Democrats have put legislation responding to the Equifax

hack at the top of their agenda next year. A handful of existing

proposals, some bipartisan, offer a road map for possible changes

to how the industry handles consumer information, including

subjecting credit-reporting companies to tougher cybersecurity

standards and making it easier for consumers to fix errors on their

credit reports.

"The Equifax data breach response is far from over," said Jaret

Seiberg , an analyst for Cowen Washington Research Group. "There

will be more legislation in the next two years that impacts Equifax

and the other credit bureaus."

An Equifax spokesman said the company has already undertaken "a

host of security, operational, and technological improvements"

since the breach.

Lawmakers from both parties harshly criticized Equifax after the

company announced the data breach that resulted in the loss of

Social Security numbers and other sensitive personal information of

147.9 million people.

That led to the proposal of several bills to increase oversight

of credit- reporting companies, which collect data on consumers'

financial history to help lenders vet applications for mortgages,

credit cards and other products that require a gauge of

credit-worthiness. Legislation mostly stalled, however, amid

pushback from the industry and disagreement between Republicans and

Democrats over what should be done.

One exception was a provision to allow adults and children to

freeze and unfreeze their credit reports free of charge to prevent

identity thieves from using their information to open new accounts.

That was approved earlier this year as part of a broader banking

bill.

Rep. Maxine Waters (D., Calif.), the incoming chair of the House

Financial Services Committee, wants to revive the credit-reporting

debate, saying her panel would focus on the industry and use as a

template a bill she introduced last year to overhaul the

industry.

Those proposals include enhancing consumers' ability to fix

credit-reporting errors by making it easier to dispute the accuracy

of information contained in reports, and requiring companies to

present documents used as a basis for disputed information. Another

provision would prohibit employers from using credit reports.

"I believe that credit reporting reform and holding Equifax

accountable for its massive breach are bipartisan issues that touch

nearly every American," she said in November. Her committee is

expected to hold a hearing in early 2019 on the issue, possibly

with testimony from top officials at the three main credit-

reporting companies, Equifax, Experian PLC, and TransUnion.

Any proposals must have bipartisan support to clear both

chambers of Congress, where Democrats will control the House and

Republicans the Senate.

Some Senate Republicans, including Senate Banking Committee

Chairman Mike Crapo (R., Idaho), have expressed interest in the

issue, raising the prospect of a bipartisan deal. Sens. John

Kennedy (R. La.,) and Brian Schatz (D., Hawaii), for instance,

proposed legislation in March to give consumers more control over

their credit reports. This included requiring the top

credit-reporting companies to create a website for consumers to get

free access to their credit information and easily opt out of

having their data shared or sold to third parties.

Rep. Patrick McHenry (R., N.C.), expected to be the top

Republican on the House financial services panel, has proposed

submitting credit-reporting companies to government cybersecurity

examinations as part of a bill he introduced in 2017.

Trying to fend off the legislative proposals, the

credit-reporting industry said government oversight has already

increased in response to the hack, with the Consumer Financial

Protection Bureau starting to examine the companies for data

security.

"A lot has already been done," said Francis Creighton, chief

executive of the Consumer Data Industry Association, a trade group

for the industry. "It's important to point out good things have

happened since the Equifax crisis."

Mike Litt, consumer campaigns director for U.S. PIRG, a consumer

group, urged Congress to do more. "More than a year later, Equifax

hasn't paid the price for losing nearly 150 million Social Security

numbers," he said.

The House Oversight Committee, which has responsibility for data

security, issued reports in December that were critical of the

Equifax breach, setting the stage for the congressional debate next

year. The Republican report, based on findings from a 14-month

investigation, concluded the incident was "entirely

preventable."

Democrats in their own report separately listed several

legislative solutions, including requiring Equifax and other

government contractors to comply with tougher cybersecurity

standards and drawing up a framework for how companies notify

data-breach victims.

Write to Yuka Hayashi at yuka.hayashi@wsj.com

(END) Dow Jones Newswires

January 01, 2019 13:08 ET (18:08 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

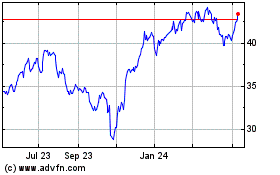

Experian (QX) (USOTC:EXPGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

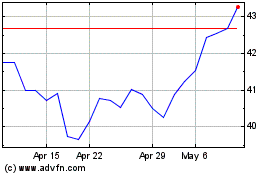

Experian (QX) (USOTC:EXPGY)

Historical Stock Chart

From Apr 2023 to Apr 2024