Abu Dhabi's Adnoc Inks $5.8 Billion in Refining Deals With Eni and OMV

27 January 2019 - 11:56PM

Dow Jones News

By Summer Said

DUBAI -- State-owned Abu Dhabi National Oil Co., or Adnoc, said

Sunday it has signed agreements worth $5.8 billion with two

European energy companies for a share in its refining unit and to

create a new trading operation.

Italian energy company ENI SpA has acquired a 20% stake and

Austria's OMV bought a 15% share in Adnoc Refining, with Adnoc

owning the remaining 65%, the companies said in statements.

Adnoc Refining, which has a total refining capacity of 922,000

barrels a day operates the fourth largest single site refinery in

the world, is valued at $19.3 billion. OMV said it would pay around

$2.5 billion, while Eni said it would pay around $3.3 billion.

The partners will own the same proportions of the joint trading

venture, the companies said.

Adnoc said the new trading venture will provide expanded market

access for refining products with export volumes equivalent to

about 70% of throughput.

Both ENI and OMV previously have signed deals with Adnoc for

stakes in Abu Dhabi's oil fields.

Write to Summer Said at summer.said@wsj.com

(END) Dow Jones Newswires

January 27, 2019 07:41 ET (12:41 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

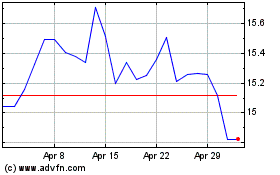

Eni (BIT:ENI)

Historical Stock Chart

From Mar 2024 to Apr 2024

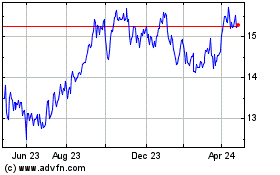

Eni (BIT:ENI)

Historical Stock Chart

From Apr 2023 to Apr 2024