Danish Drugmaker Expects Higher Working Capital as Brexit Looms

02 February 2019 - 4:48AM

Dow Jones News

By Nina Trentmann

Danish insulin maker Novo Nordisk A/S is forecasting a rise in

the working capital it would need as it prepares for a potentially

disruptive Brexit, including product stockpiles and alternative

means of drug transportation.

"We have more than doubled our [U.K.] inventories," Chief

Financial Officer Karsten Munk Knudsen said in an interview with

CFO Journal on Friday. The Bagsvaerd, Denmark-based company is

currently storing 16 weeks of drug supply in the U.K. ahead of

Britain's exit from the European Union on March 29.

This will result in higher working capital at Novo in the coming

quarters, said Mr. Knudsen, without quantifying the potential

increase. The company reported working capital as a percentage of

sales of 4.4%, or 4.9 billion Danish kroner ($750 million), in

2018.

The U.K. accounts for 2% to 3% of Novo's global sales, but it

doesn't manufacture in the country.

Companies from a range of sectors, including manufacturing and

food production, have taken similar actions as they await the terms

of Britain's departure from the European Union. Lawmakers on

Tuesday voted for a renegotiation of the Brexit deal that the

government and the EU agreed to in the fall.

The disagreement between the government and parliamentarians is

creating a delay, increasing the potential for a last-minute deal

or a no-deal Brexit on March 29. In such a scenario, tariffs could

apply from day one of the new regime, March 30, and goods to and

from the U.K. would have to clear customs, potentially resulting in

significant costs and delays at the border.

Novo said it exploring alternative ways to transport its drugs.

"We are normally shipping our products [to the U.K.], but now, we

are also looking at airfreight," Mr. Knudsen said.

That also may not be an ideal solution. Under a no-deal Brexit,

flight connections between the U.K. and the EU would remain in

place, but there may be fewer daily flights, according to

contingency plans released by the European Commission in December.

"This might present another challenge," said Mr. Knudsen.

That is one of the reasons why the company is stockpiling in the

U.K. Novo recently rented additional storage space in the U.K. Many

of the company's products need to be refrigerated, adding to the

problem, Mr. Knudsen said.

Novo would be "reasonably exposed" in a no-deal Brexit scenario,

said Wimal Kapadia, an analyst at Sanford C. Bernstein &

Co.

The drugmaker on Friday reported that net profit for the three

months ended Dec. 31, 2018, increased 8.50 billion Danish kroner

from 8.25 billion Danish kroner a year earlier, falling short of

the 8.90 billion Danish kroner forecast by analysts in a FactSet

poll.

Novo generates roughly half of its revenues, and a sizable part

of its profit, in the U.S. There, net prices have fallen, by

roughly 21% for basal insulin in 2018, one of the company's core

products, according to Mr. Kapadia. "We see that our average net

pricing is down," Mr. Knudsen said.

Write to Nina Trentmann at Nina.Trentmann@wsj.com

(END) Dow Jones Newswires

February 01, 2019 12:33 ET (17:33 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

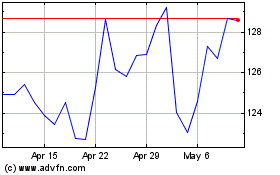

Novo Nordisk (NYSE:NVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

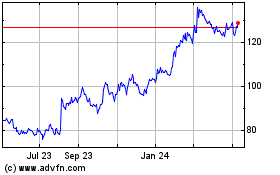

Novo Nordisk (NYSE:NVO)

Historical Stock Chart

From Apr 2023 to Apr 2024