Cognizant to Pay $25 Million to Settle Bribery Claims

16 February 2019 - 5:17AM

Dow Jones News

By Samuel Rubenfeld and Dave Michaels

Two former executives of Cognizant Technology Solutions Corp.

were charged by U.S. authorities with foreign bribery for allegedly

approving illicit payments in India to build a corporate campus

there.

The Teaneck, N.J.-based company also agreed to pay $25 million

to settle with U.S. authorities.

Gordon Coburn, the company's former president, and Steven

Schwartz, its former chief legal officer, were charged in a

12-count indictment returned Thursday by a federal grand jury in

New Jersey, prosecutors said. The two men authorized a $2 million

bribe to at least one government official in India to secure

permits necessary for the construction of an office campus in India

to support about 17,000 employees, prosecutors said.

"The allegations...describe a sophisticated international

bribery scheme authorized and concealed by C-suite executives of a

publicly-traded multinational company," Brian A. Benczkowski, an

assistant attorney general, said in a statement.

They were charged with three counts of violating the Foreign

Corrupt Practices Act, as well as seven counts of falsifying books

and records, a count of circumventing accounting controls and a

conspiracy count.

The FCPA, which is jointly enforced by the Justice Department

and the Securities and Exchange Commission, prohibits the use of

bribes to government officials to get or keep business.

The two men were also sued in a civil complaint by the SEC,

which seeks permanent injunctions, monetary penalties and

officer-and-director bans against them.

Hank Walther, an attorney for Mr. Coburn, said he's disappointed

that U.S. authorities chose to pursue the allegations. "Mr. Coburn

intends to vigorously fight all charges," he said.

A lawyer for Mr. Schwartz didn't immediately respond to requests

for comment.

Prosecutors also on Friday announced that they declined to

prosecute the company, citing Cognizant's self-disclosure of the

allegations, as well as its cooperation and remediation.

Cognizant settlement includes $19 million in disgorgement and a

$6 million civil penalty, to the SEC to resolve the agency's

claims.

Cognizant said it was pleased to resolve the case, citing its

voluntary self-disclosure, internal investigation and cooperation.

"It is important to note that this entire matter did not involve

our work with clients or affect our ability to provide the quality

services our clients expect from us," said Francisco D'Souza, the

company's vice chairman and CEO, in a statement.

Shares in Cognizant traded at $73.27 on Friday, a 0.21% increase

over Thursday's closing price, according to FactSet.

Write to Samuel Rubenfeld at samuel.rubenfeld@wsj.com and Dave

Michaels at dave.michaels@wsj.com

(END) Dow Jones Newswires

February 15, 2019 13:02 ET (18:02 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

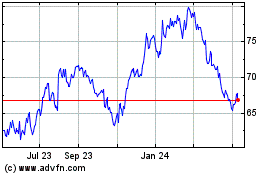

Cognizant Technology Sol... (NASDAQ:CTSH)

Historical Stock Chart

From Mar 2024 to Apr 2024

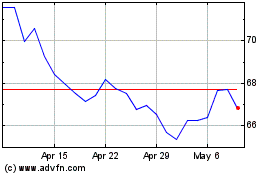

Cognizant Technology Sol... (NASDAQ:CTSH)

Historical Stock Chart

From Apr 2023 to Apr 2024